What is a credit line and what does it mean?.

Loans have long become an integral part of the banking system. All clients know about them, even those who do not take loans. However, few people clarify and understand related topics, such as what a credit line means.

Moreover, very few know what a revolving credit line is. Even seasoned clients can be unclear about these terms. It is important to understand what it is, how it works, and how to use it to one’s advantage.

What is a credit line in a bank?

Let’s start with what a credit line card is in a bank. It is a rather simple tool from a bank (or another financial institution) that allows the borrower to dispose of a certain amount within a limit. Essentially, it is also a revolving facility. That is, the client receives a certain limit, withdraws part of it, repays it, then withdraws part of it again, and repays it again. This is a flexible and convenient financial tool that is often used in both business and personal finance. It is flexible because there is no fixed amount and repayment date.

There are several such lines in the banking system. The divisions are conditional and relate more to the terms of using the limit. There is the so-called revolving credit line, which is also regarded as the most flexible. The borrower can use the money at any Time within the established limit, and as the debt is repaid, the amount becomes available again for use.

To understand how it works, here’s an example. There is a credit line of 100 thousand, but one can withdraw 50 thousand at a time. When the client repays the debt, they can withdraw another 50 thousand.

There is also a non-revolving credit line. In this case, the client receives the amount in parts, but these parts have their own total amount. When the client reaches that amount, the limit is closed. Once the debt is repaid, they can again take amounts in parts. For example, there is a limit of 100 thousand. This amount can be withdrawn in parts up to 100 thousand, but it is not possible to withdraw the entire amount at once. As soon as 100 thousand has been withdrawn in parts, the limit is exhausted. After that, the amount can only be repaid.

It is also worth mentioning overdrafts. This is a form of a credit line where the borrower can spend funds beyond the balance in their bank account. Overdrafts are often used to cover short-term cash gaps. We must not forget about target credit lines. Such credits are always taken for a specific purpose. Hence the main name. Usually, credits are taken for large purchases.

Why is a credit history needed at all?

The credit history system in Ukraine is just beginning to develop, while in the West it has long been a functioning scheme. Having a credit history is beneficial and effective, both for businesses and for ordinary citizens.

Typically, a credit history is built by: the bank client taking various loans and paying them regularly, which increases their credit rating. The more repaid loans, the better. Then in the future, if they need a loan for business or to purchase a car or house, there will be no problems. In Ukraine, however, many still fear the topic of loans. They are usually associated with deception and a debt trap.

Today, in the best banks in Ukraine, a credit line operates on a fairly simple principle: the bank sets a maximum limit within which the borrower can take money as needed. This can be the amount in the form of a full credit line or partial loans. The credit limit has many additional conditions, particularly regarding who and what is issued.

If we talk about the procedure of how and to whom loans are given, it is worth highlighting:

-

Approval of the limit. The bank approves the maximum amount that the borrower can use. This may depend on the credit history, income, and other factors.

-

Using funds. The borrower takes money in parts or in full, depending on their needs.

-

Accruing interest. Interest is charged only on the part of the amount that has been used. If the borrower does not use the money, interest is not accrued.

-

Repayment of debt. As the borrower returns the used funds, the limit becomes available once again for use.

In practice, this entire process is quite simple and fast. It is important to mention from the outset that a credit line does not always indicate the loan itself. Usually, it is an amount equal to how reliable the client is for the bank.

For example, a client may have a regular payment card at the bank and receive small payments on it. Then they might take several small loans and make payments on them. In the eyes of the bank, they are reliable, but the amounts on the card (turnover) and the sizes of the loans are always small, therefore, the bank will not give such a client a large credit limit anyway. That is, the reliability and honesty of the client are important, but they are not the only decisive factors. In some cases, building a credit line may take years.

Read also

- China Has Made Rice Significantly Tastier

- New vector of development: a boom of industrial parks in Ukraine

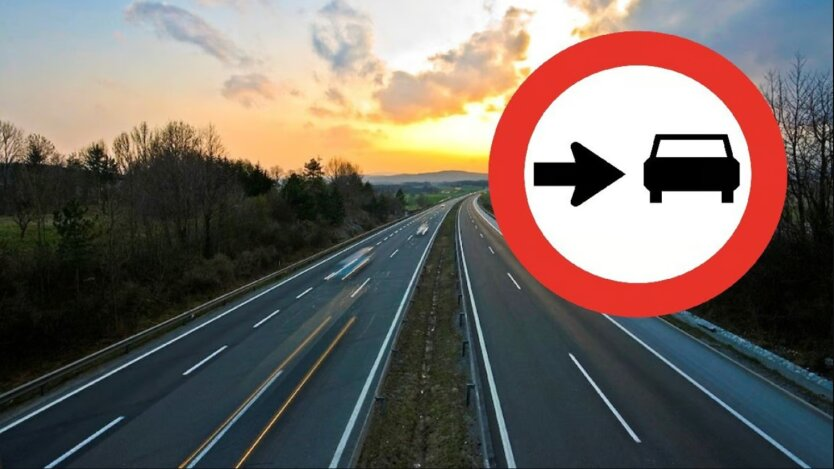

- Sign with a black arrow and a car: drivers explained what it prohibits

- Important condition for Ukrainians in Poland: without this, '800 Plus' will not be paid anymore

- Pension Indexation: Who Will Receive Additional Payments Ranging from 300 to 1000 Hryvnias Starting March

- Zelensky responded to complaints about the transfer of military personnel from the Air Force to the Ground Forces