Loans will become more expensive due to new taxes - bankers.

Increased taxation of banks, businesses and individuals may negatively affect the lending situation, banking experts note.

This opinion was expressed by participants of the round table "Winter is coming: is business ready for energy challenges and the new tax reality", organized by the Financial Club.

"It is especially difficult for banks that have been paying 50% tax for two consecutive years. This affects businesses, capital, and the margin that banks factor into the cost of loan resources," said Valeriy Terno, head of corporate sales management at OTP Bank. "Next year, this will affect the cost of funds, which may influence the cost of loan resources."

If businesses and individuals respond to additional taxation by switching from cashless payments to cash, it will lead to a decrease in bank liquidity. "The reduction of client accounts and the deposit portfolio increases the cost of financing. This unpredictability will negatively affect the development of the economy of our country," stressed Oleh Fedorenko, director of the corporate client sales department at TAScombank.

In the case of a transition to cash settlements, it will be a negative scenario. "The population will withdraw money from accounts and spend it in stores, which will cause a resource deficit for financing and lead to an increase in the cost of financing," he explained.

Read also

- For the first time not under US leadership: it became known when the new 'Ramstein' meeting will take place

- Zelensky extended martial law and mobilization: new term

- Ukraine returned 150 servicemen of various branches of the military from captivity, - Zelensky

- The EU will focus on supplying weapons and ammunition to Ukraine - von der Leyen

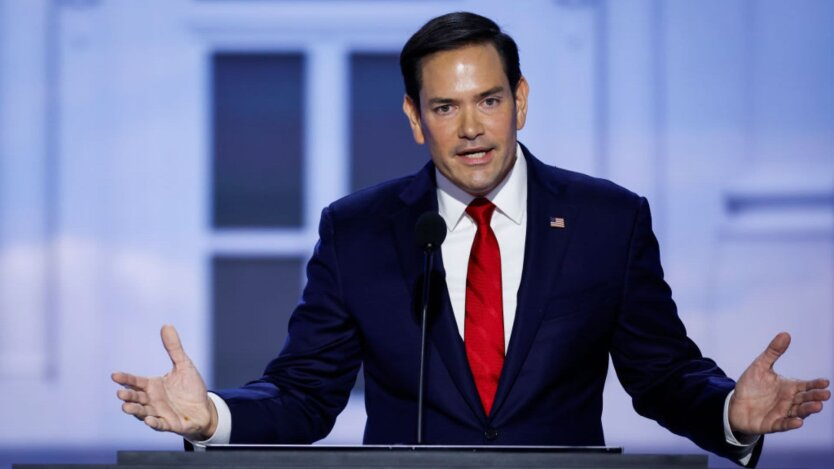

- Rubio made a statement regarding the likelihood of Canada joining the United States

- EU establishes legal framework for special tribunal for crimes of the Russian Federation against Ukraine