What is a crypto mixer and a bitcoin mixer.

Earnings on cryptocurrency can come easily if many useful processes are taken into account. For example, how does a bitcoin mixer work, and in general, what it is, how it is used, and in simple terms, how it can help earn money.

It is also necessary to understand the cryptocurrency mixer, its principle of operation, and all the dangers (risks) that lurk behind it. But first of all, one must study the topic, what a bitcoin mixer is for a beginner and an experienced investor.

Mixer for bitcoins

So, what is a cryptocurrency mixer: it is a special service that helps to remain anonymous. After all, in the world of cryptocurrencies, anonymity and confidentiality play an important role. However, despite the fact that bitcoin and other cryptocurrencies are often perceived as anonymous, their transactions are actually easily traceable. This also carries its own risks, which investors try to circumvent in every possible way. Anyone can see the transaction history for a given address due to the open nature of the blockchain. This creates a demand for technologies that allow increasing the level of privacy. One of these tools is the crypto mixer, also known as the bitcoin mixer.

That is, such a service does not directly help to earn money, but helps to be a fully-fledged investor. The main goal of the mixer is to complicate the tracing of cryptocurrency transactions so that no one can determine where the coins came from or where they went.

The principle of operation of the mixer

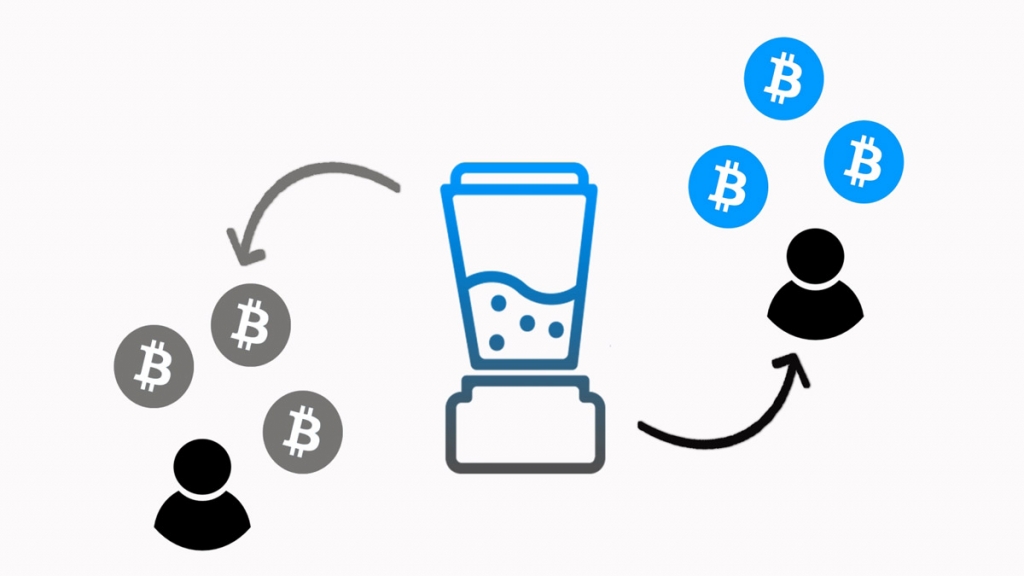

When a user sends their coins to the mixer, the service mixes them with coins from other users and then sends them to the specified address. As a result, the origin of the coins becomes blurred, and tracing the transaction chain is practically impossible. In other words, to put it simply, it is some kind of masking.

Often such a mixer helps investors to earn safely on bitcoin. Hence the name bitcoin mixer. Bitcoin is the first and most well-known cryptocurrency, with a transparent blockchain system where anyone can see the transaction history. This is associated with the popularity of bitcoin mixers. The use of mixers allows bitcoin users to maintain confidentiality and avoid excessive attention to their transactions. The principles of operation of such a mixer:

-

First of all, this is ensuring confidentiality. Users do not want their financial operations to be accessible to everyone.

-

It is also about ensuring security. Protection against potential threats associated with the open information about transactions.

-

It would also be appropriate to recall business objectives. Sometimes companies want to hide financial activities for objective reasons.

The principle of operation of the mixer can be described in several stages that occur when a user sends their coins to the mixer. This process has its understandable stages:

-

First, the coins must be sent to the mixer. The user sends their bitcoins or other coins to the mixer address.

-

Next, a kind of mixing of coins takes place. The mixer combines the received coins from different users, mixes them, and blends them with coins from its reserves.

-

After that, the separation and sending of coins occurs. After mixing, the mixer sends the cleaned coins to the specified addresses. These can be several addresses for greater confidentiality.

This principle of operation may be simple, but it is understandable.

What types of crypto mixers are there?

Crypto mixers come in different types, and each of them can use various methods to achieve anonymity. In general, there are not many types, but all of them are useful:

-

The first and most trusted option is centralized services. They are managed by companies or individuals. They require trust from the user since the service controls all operations. Among the advantages of such a mixer is high speed of work. However, there are also disadvantages. This is the need to trust the service, the risk of fund theft.

-

There are also decentralized services. They operate on the principle of peer-to-peer networks, where users exchange coins among themselves without the involvement of intermediaries. Among the advantages are the absence of intermediaries and high confidentiality. However, there are also disadvantages to such services. This includes more complex operation, requiring certain technical skills.

-

A rarer type of mixer that can also be found is smart contract mixers. These mixers operate on the blockchain and use smart contracts to perform operations. For example, for Ethereum, there are decentralized mixers that provide anonymity through smart contracts.

Each of these mixers can be used if one understands their principle of operation in detail.

What are such mixers used for?

Such mixers exist because they are useful and very effective. The main advantages of mixers for cryptocurrency:

-

Increased confidentiality. Mixers allow hiding the source and recipient of transactions, making operations more confidential.

-

Also, thanks to mixers, one can protect against surveillance. By using mixers, users can safeguard themselves from potential tracking of their transactions. This is especially important for those engaged in business or owning large sums in cryptocurrency.

-

If one chooses a standard mixer, personal data can be protected. Although blockchain is anonymous, addresses can still be tied to users through third-party services. Mixers help keep personal data confidential.

In general, one can manage without mixers, as they also have their own risks. What is being discussed:

-

Restrictions that are regularly increasing on such services. In some countries, the use of crypto mixers is prohibited since such services can be used for money laundering.

-

There are also risks of money theft. Centralized mixers can turn out to be unreliable, and the user risks losing their money.

-

Additionally, there are high fees. Some mixers charge significant fees for their services, which may be unprofitable for users with small amounts.

Therefore, before choosing such a mixer, it is necessary to evaluate all the pros and cons.

Read also

- What is the Solana cryptocurrency in simple terms

- What is cryptocurrency Ethereum in simple terms

- What will happen to cryptocurrency in 2025

- What Will Happen to Bitcoin in 2025

- The Best and Most Popular Altcoins: Top 10 Rating

- How to Pay with Cryptocurrency