What is a debit card and what is it used for.

Debit cards have long been familiar and understandable for most customers. However, even despite their popularity, many still do not understand well what a debit card is and how such a card differs. Moreover, in order to understand what it is, one should also understand why it is needed.

When figuring out the question, what does a debit card mean, it is also important to learn about its differences from a regular credit card. Knowing what it is will also be useful. Generally, understanding what a debit card is will be beneficial for everyone.

Settlement card: what you need to know about it?

So, what kind of card is a debit card and what is it needed for? A debit card is a plastic card linked to a bank account. In other words, it is a simple option that has no relation to loans or other payments. You can deposit funds into this card and then manage them. With this card, you can easily make purchases or pay for services. Personal fund transfers are also available.

It should be noted right away that while its functions may be similar to those of a credit card, these are different types of tools. The main difference between a debit card and a credit card is that a customer can only spend the money that is already on the account, not borrow money from the bank. Essentially, whatever amount the customer has deposited into the account is what they can spend. This type of card is also referred to as "for disbursements. "

What are the features of such a card:

-

This card has a direct link to a single account that the client opened at the bank. This means that all calculations across different cards can be done quite simply and conveniently.

-

No debt - you cannot spend more than what is in the account.

-

Fees and tariffs - various fees (for example, for cash withdrawal, conducting operations abroad) may be charged for the maintenance of the card.

Such cards are incredibly popular, especially among customers who are afraid of loans.

A few words about how this card works

If a suitable comparison can be found, a settlement card somewhat resembles a wallet. You can use as much money as is in it. At the same Time, payments using this card occur in real-time, so you won’t have to wait for a transfer.

This card is attractive in that you don’t have to fear "getting into" debt. Therefore, from the point of view of simple financial literacy, whatever you deposited, is what you spent. And this system works well.

The principle of how a debit card works:

-

The card allows for immediate deduction of funds when making a purchase in-store or online.

-

Cash withdrawal - you can withdraw money from ATMs, both your bank's and those of third-party financial institutions.

-

If you need to constantly pay off debts in small amounts, these cards are also the simplest and most convenient. For example, to pay for internet, electricity, or gas. The same goes for transfers to close people or friends.

-

Banks offer mobile applications where you can track your balance and transaction history.

This type of card is simple and straightforward. It has many advantages.

What can you do with such a card?

A debit card is often the simplest and most straightforward solution for many customers. This card makes it easy to manage finances and overall understand how to allocate personal funds. What are the significant advantages of such a card:

-

Such cards are convenient and simple (to issue, use or close).

-

Security - if the card is lost, it can be immediately blocked, and the money remains protected.

-

Expense control - the ability to track expenses through the banking app helps better plan a budget.

-

Access to online services - the debit card is the main tool for online payments in online stores and applications.

-

International payments - the ability to use the card abroad for cash withdrawals and payments for goods and services.

Importantly, even if the card is lost, you do not need to worry that credit funds will also be withdrawn (the credit limit can be very high and will need to be paid back later).

Choosing the right tool

There are several types of debit cards that banks in Ukraine can offer. Despite the different types, they all operate on a similar principle. The choice is still large, and this is the advantage of a well-developed banking system in Ukraine.

The main types of debit cards that can be found in Ukraine:

-

Standard debit card - the optimal option for daily use.

-

Premium cards (Visa Gold, MasterCard Platinum) - cards for clients who travel internationally frequently or require extended services.

-

Co-branded cards - cards issued in collaboration with retail chains or companies providing bonuses and discounts.

-

Social cards - cards designed for receiving social payments or pensions.

Each type of these cards has its own features, advantages, and certain disadvantages (insignificant, but they are meaningful for frequent card usage).

How to get such a card?

This type of card can be found in any bank. That is, you can visit a bank branch and receive the card (the process is quite simple).

The process of obtaining a debit card in Ukraine is extremely simple. Here’s how it happens:

-

First, you need to choose a bank that offers favorable terms for servicing a debit card.

-

Fill out an application to issue such a card. It can be submitted either at the bank branch or online on the bank's website. These options are very convenient.

-

The client must provide certain documents (usually only a passport and tax ID are required).

-

Receiving the card - the card is issued within a few days after submitting the application, but there is a possibility of ordering an instant card.

Some banks issue the card immediately. It is a regular and non-personalized card. If the client wants a personalized card, they still have to wait a couple of days.

It is also important to note that each bank sets its own tariffs for servicing debit cards, and it is important to review the terms carefully before making a choice. These terms may change based on the presence of other cards (for example, credit cards) in the same bank. There may be separate terms for transferring funds between cards.

Read also

- Finland Launches Large-Scale Trade Project with Ukraine

- Ukrainian Armed Forces hit a huge ammunition depot of the occupiers in Khartsyzk, it detonates: video

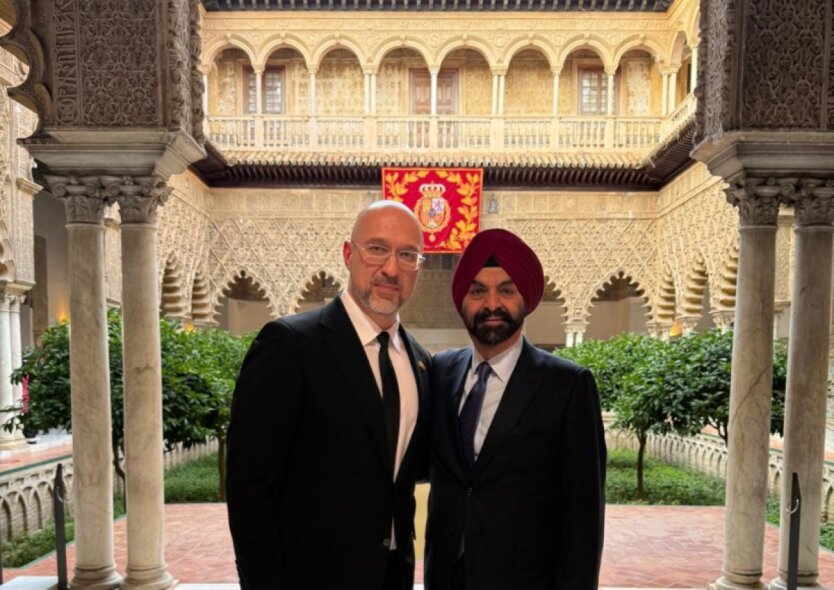

- Post-war Reconstruction: What the Government of Ukraine and the World Bank Are Planning

- Ukrainians are being sold counterfeit dollars and euros: which denominations are most often counterfeited

- Republican Congress members demanded Trump explain the suspension of arms supplies to Ukraine

- Mass Arrests of Ukrainians in Poland: What Happened