How to choose a bank: for business, deposit, and credit.

Business, like a legal entity, needs an account, and for that, a bank is necessary. The choice of a banking organization can be made based on your needs. You can take into account capabilities and commissions. It is also worth considering how often you will need to visit the bank branch or use other resources.

In general, how to choose a bank for deposit or how to choose a bank for credit depends on many factors. Such a bank should differ in a whole range of functions: be reliable, have good communication, provide separate conditions for credit, for deposit, or for business.

How to choose a bank for credit, deposit, or business?

In general, the question of how to choose a bank for a current account is asked by many clients. Not only businesses, but also those engaged in specific activities need such an account. Separately, you need to choose a bank for credit or for deposit. These are different cases with different starting conditions.

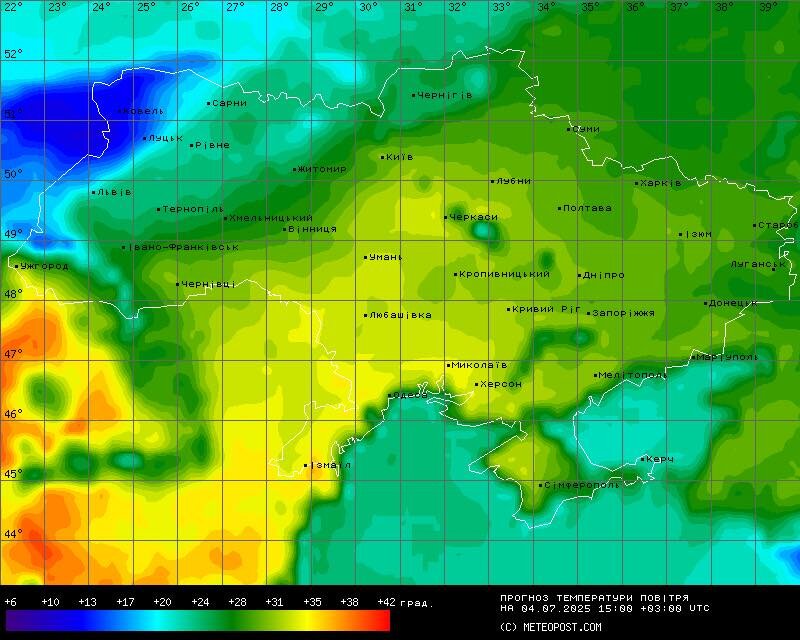

Choosing a bank is a responsible decision that directly affects the convenience and safety of your financial transactions. For Ukrainians in 2024, considering the current economic and legal conditions, it is important to focus on the reliability, transparency, and convenience of the bank.

So, to choose a bank, you need to understand what such an organization should 'give' to the client. For example, running a business requires a reliable and functional banking partner. When choosing a bank for business, it is important to consider:

-

The convenience of online banking. This is the simplicity of using the interface, the availability of mobile applications, and also the possibilities of integration with accounting programs.

-

How much the bank charges for services. This concerns the cost of opening and maintaining an account, the amount of commissions for transfers and payments, and additional fees (for example, for cash withdrawals).

-

Don't forget about quality service. First of all, this concerns quick support and the availability of branches and ATMs.

If you need to choose a good bank, it is worth considering additional services as well. For example, the availability of a lease, credit, or deposit agreement.

It is important to highlight the best banks for business in Ukraine:

-

PrivatBank – modern online banking, acceptable rates for small businesses.

-

Oschadbank – a reliable choice for large enterprises.

-

UkrSibBank – favorable conditions for foreign currency transactions.

However, smaller banks can also offer good conditions.

Which bank to choose for deposits?

The main goal of deposits is earning. Savings require reliable storage, so the choice of a bank for deposits and savings plays an important role.

How to choose a bank for these purposes:

-

Interest (interest rate). To do this, compare the rates on deposits at different banks, and also consider that the rates may vary depending on the term of the deposit.

-

You should assess the reliability of the bank. To do this, study the bank's rating and the availability of deposit insurance.

-

You should find out about the conditions for early withdrawal. This is the possibility of withdrawing money without losing interest.

In general, it is important to choose a bank that is convenient for managing the deposit. This concerns online access to the deposit and the simplicity of opening an account.

TOP banks for deposits in Ukraine specifically for deposits:

-

PrivatBank – high reliability, user-friendly interface for management.

-

Monobank – transparent conditions, high interest on deposits.

-

Alfa-Bank – flexible conditions for early withdrawal.

These banks guarantee the best interest rates.

Suitable bank for credit

Completely different conditions may apply for lending. To obtain a loan in Ukraine, it is important to pay attention to the following aspects:

-

How much interest you will have to pay. Compare the offers of different banks. Also consider the effective rate, including hidden fees.

-

You need to evaluate what loan terms the bank offers. Banks offer different terms for consumer and mortgage loans, so consider your financial capabilities for repayment.

-

It is worth assessing the fees. Check for any fees for processing the loan.

A good bank should guarantee transparency of the conditions of the loan agreement. In general, study the contract carefully, avoid hidden payments. To check the bank’s reputation, you need to study customer reviews.

Popular banks for loans in Ukraine:

-

PrivatBank – a wide range of credit products, including loans for business.

-

UkrGazBank – preferential lending programs for environmental projects.

-

Monobank – quick processing of consumer loans.

When choosing a bank, it is important to consider:

-

The quality of customer support.

-

The availability of loyalty programs.

-

The security of operations.

Choosing a bank in Ukraine in 2024 depends on your financial goals: running a business, saving money, or obtaining a loan. Explore the offers, compare the terms, and consider the reliability of the bank.

Read also

- What is emission in simple terms

- What is an embargo in simple terms

- What is a moratorium in simple words

- What is the Gini coefficient in simple terms

- What is debt consolidation in simple words

- What is institutionalism in simple terms