Monobank how to buy currency: dollars and euros.

Among classical banks in Ukraine, there is also Monobank. Unlike other banks, it has no regular counters or branches. While this is quite convenient, it often raises questions, for example, how to buy currency in Monobank or use the bank instead of a currency exchange.

However, it is still possible to buy currency at Monobank. And it is possible to exchange dollars and euros, the most popular foreign currencies. Moreover, even a newcomer will be able to buy currency online at Monobank, as this procedure is quite simple.

How to buy dollars at Monobank?

Let’s start with who Monobank is: Monobank is the first fully mobile bank in Ukraine, which provides banking services exclusively through a mobile application. Therefore, it is not possible to personally buy dollars at Monobank, no matter where the client is.

To understand how this works, one needs to grasp the operational principles of the bank itself. What it is about:

-

Completely online. Monobank has no physical branches, allowing clients to solve all financial questions through the app. This makes the bank convenient and accessible 24/7, without the need to visit branches.

-

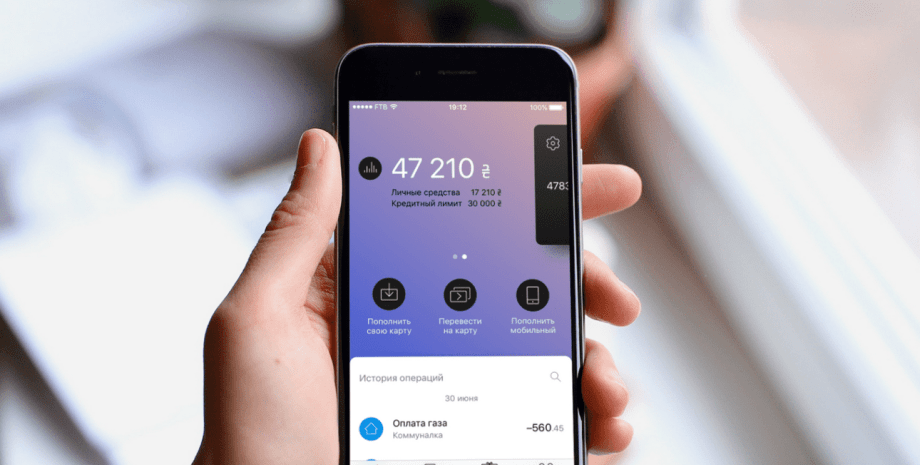

Convenient mobile application. All operations, including account opening, transfers, payments, card management, currency purchase, and even loan applications, can be performed through the user-friendly interface of the mobile application. The Monobank app has won multiple awards for its intuitive and functional design.

-

High service speed. Due to the absence of bureaucracy and physical infrastructure, many banking services in Monobank are provided faster than in traditional banks. For example, transfers between Monobank cards happen instantly, and loan approvals take just a few minutes.

-

Attractive loan and deposit conditions. Monobank offers competitive interest rates on loans and deposits. Additionally, the bank frequently runs promotions and provides bonuses for clients, making the use of their services even more advantageous.

Such a bank attracts clients with several bonus programs. Monobank offers a cashback system (return of a portion of funds for purchases), which is individually customizable. Clients can select categories for cashback each month, enabling them to make the most of the loyalty program.

The most significant advantage of the bank is quick online registration and account opening. Clients can open accounts and cards in various currencies (hryvnias, dollars, euros) through the app in just a few minutes. A physical card can be delivered to one's home or picked up at partner branches.

Currency exchange through Monobank

Clients appreciate Monobank for its wide range of financial services. Monobank offers services such as credit and debit cards, deposits, loans, currency operations, installment plans, insurance, and investments. This means that the client has the right to exchange foreign currency immediately upon opening an account. This makes Monobank a full-fledged financial partner for most users.

Overall, Monobank regularly implements new features and technologies, focusing on modern customer needs. This includes access to Apple Pay and Google Pay, utility bill payments, ticket purchases.

To buy currency (dollars or euros) through Monobank, one should:

-

Install the Monobank app. If the client does not yet use Monobank, they should download and install the app on their smartphone. Registration in the system will require uploading a passport and identification code (TIN), as well as passing identification.

-

Open currency accounts. To purchase currency, accounts in dollars and/or euros need to be opened. For this, go to the Monobank app, navigate to the "Cards and Accounts" section, and select "Open New Account". After that, choose the currency, for example, dollars. Then confirm the opening of such an account.

-

To buy currency, there must be a sufficient balance in the hryvnia account. It can be replenished via transfer, a card from another bank, or Monobank terminals.

-

The actual currency purchase. First, open the Monobank app, then go to the "Currency Rates" section or select the currency account, and then press "Buy Currency". After this, select the account from which hryvnias will be deducted and the account to which the currency will be credited. Next, confirm the operation.

The operation is quite simple, and anyone can perform it quickly.

In addition, some nuances of transfers should be taken into account:

-

Limits. Monobank may set limits on currency purchases within a day or a month.

-

Rate. The currency purchase rate in the Monobank app may differ from the official NBU rate. Pay attention to the rate before confirming the operation.

-

Commission. In most cases, currency purchases are made without commission, but check the conditions before purchasing.

Afterwards, the currency can be left in the account, transferred to another account, or withdrawn from an ATM.

Read also

- Last warning - what will change for individual entrepreneurs from August 1

- Ukrainians can access budget eggs - where to save significantly

- eOselya — who cannot qualify for affordable lending

- Koreans will build a waste incineration plant in Odesa - what are the timelines

- Problematic dollars — which banknotes cannot be exchanged

- Discounts on products up to 55% — what is offered at Silpo significantly cheaper