Rating of banks in Ukraine: TOP 10 by loans, reliability, and assets.

Ukraine has a fairly developed banking system. Moreover, the ranking of banks in Ukraine today is large and extensive. At the same Time, there are different rankings of banks in Ukraine based on assets and rankings of banks in Ukraine based on loans, but there are also universal options.

In general, the ranking of banks in Ukraine based on reliability will be useful for all clients. Reviews do help, as does the TOP 100. Although the concept of reliability is relative, as all banks have their advantages and disadvantages.

Ranking of Banks in Ukraine by Profit

Undoubtedly, the ranking of banks in Ukraine by reviews in 2024 reflects many aspects. For example, reliability and a stable lending system, deposits. Overall, in 2024, under wartime conditions, many development tools for banks are lacking, so it is quite difficult to “stay afloat.”

Despite this, Ukraine has a developed banking system, in which each bank offers its own terms for clients. One of the main criteria when choosing a bank is its reliability, lending conditions, and assets.

Speaking of the top 10 or even 20 banks in Ukraine, around 5 will be relevant. These are PrivatBank, Oschadbank, Ukrgasbank, Alfa-Bank, and Raiffeisen Bank.

PrivatBank

This bank has quite high reliability and incredible trust from clients. It is necessary to mention the bank's lending conditions:

-

Consumer loan: from 0.01% to 3.5% per month.

-

Credit card: up to 100,000 UAH, grace period up to 55 days.

PrivatBank is the largest state bank in Ukraine with the highest asset indicators. It offers a wide range of credit programs for individuals and legal entities, including credit cards, mortgage lending, and auto loans. Thanks to state support, PrivatBank is considered one of the most reliable banks.

Clients love this bank for its quick service and a large number of ATMs in different cities. The bank has a convenient app.

Oschadbank

One of the oldest and state-owned banks, which may not be the most popular but is definitely reliable. Many citizens choose it to receive their salaries or pensions through the bank. The bank's lending conditions:

-

Mortgage: from 7% per annum.

-

Consumer loan: from 13.99% per annum.

Oschadbank is the second-largest state bank in Ukraine. It stands out for its reliability and stability, which is especially important for clients seeking long-term loans, such as mortgages. The bank also offers preferential lending programs for purchasing housing and vehicles.

During the war, many banks, like PrivatBank and Oschad, created a unified system for withdrawing cash without additional criteria. This became a significant factor for Ukrainians in the first months of the war.

Ukrgasbank

Also a quite popular bank in Ukraine. Its lending conditions:

-

Mortgage: from 7% per annum.

-

Eco-loans: from 5% per annum.

Ukrgasbank specializes in lending programs for energy-efficient projects and offers for businesses. Its preferential eco-loans attract the attention of companies and individuals interested in investing in sustainable development. Ukrgasbank is actively developing the mortgage lending segment with state support.

The bank is quite safe and reliable but not as popular as PrivatBank.

Alfa-Bank Ukraine

A fairly popular bank that is in demand, but among clients, it is not considered the most reliable. Its reliability is rated as average. Meanwhile, consumer loans at the bank range from 0.01% to 2.99% per month, and the limit on a credit card is up to 200,000 UAH, grace period up to 62 days.

Alfa-Bank Ukraine is one of the largest private banks. It offers diverse consumer lending programs, including credit cards with favorable terms. The bank steadily grows in asset volume and actively attracts new clients.

Raiffeisen Bank

Another quite popular bank in Ukraine, especially before the war. The bank's lending conditions:

-

Consumer loan: from 14.5% per annum.

-

Mortgage: from 8.8% per annum.

Raiffeisen Bank is part of an international financial group, which makes it one of the most reliable banks in the Ukrainian market. It offers competitive lending programs for both individuals and businesses. The bank gained particular popularity due to its favorable mortgage programs and auto loans.

The bank has partially exited the Russian market, but the continuation of its operations in the territory of the aggressor state has forced many Ukrainians to refuse the bank's services.

PUMB (First Ukrainian International Bank)

A rather "young" bank that is gradually increasing its number of clients. Trust in the bank is average but is gradually growing. Lending conditions:

-

Cash loans: from 12.99% per annum.

-

Credit cards: limit up to 75,000 UAH, grace period up to 62 days.

PUMB offers one of the widest assortments of credit programs on the market, including cash loans and credit cards. In recent years, the bank has been actively increasing its asset portfolio and working on improving service for its clients.

UkrSibbank

Another bank that deserves attention. It has mortgage conditions starting from 9.5% per annum and loans from 12%.

UkrSibbank is part of the BNP Paribas group, which guarantees high reliability and international service standards. The bank specializes in mortgage lending and auto loans, offering competitive interest rates and conditions for clients.

OTP Bank

Another bank that Ukrainians may pay attention to. It has average reliability, at least according to clients' words. What are the terms of this bank:

-

Consumer loan: from 16.99% per annum.

-

Mortgage: from 8.5% per annum.

OTP Bank is part of a Hungarian banking group that provides a variety of credit programs for individuals. The bank actively offers mortgage loans and consumer programs with flexible terms for clients.

Read also

- Gas stations show impressive price range for A-95 in Kyiv: from 53 to 62 hryvnias per liter

- Own business: in which areas do Ukrainians most often open a business

- Finland Launches Large-Scale Trade Project with Ukraine

- Ukrainian Armed Forces hit a huge ammunition depot of the occupiers in Khartsyzk, it detonates: video

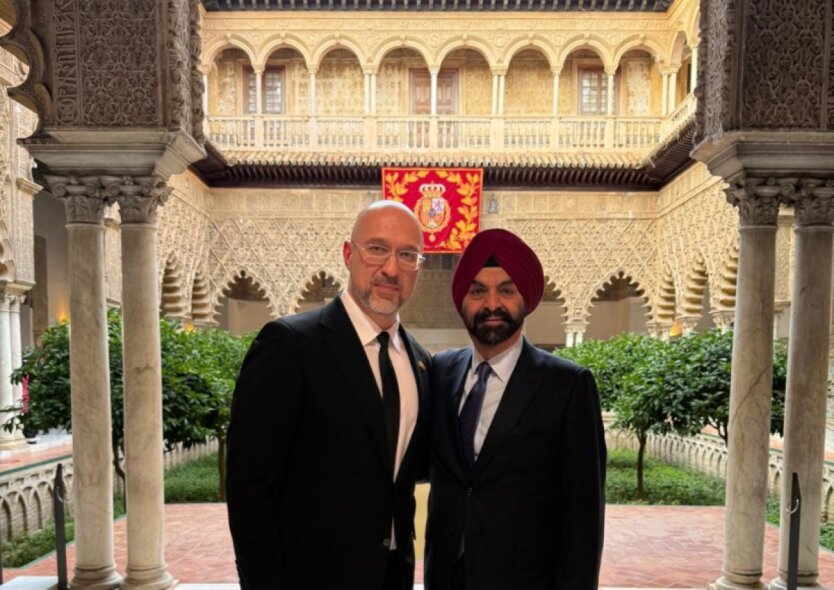

- Post-war Reconstruction: What the Government of Ukraine and the World Bank Are Planning

- Ukrainians are being sold counterfeit dollars and euros: which denominations are most often counterfeited