The price of gold sets records: should Ukrainians invest in the precious metal?.

24.04.2025

3337

Journalist

Shostal Oleksandr

24.04.2025

3337

Ukrainian citizens can buy gold at banks, but this is a long-term investment rather than a quick profit, especially in the context of the world record rise in gold prices. This was reported by the director of the financial markets and investment activities department of Globus Bank, Taras Lesovyi, in a comment to RBK-Ukraine. 'Buying gold (coins or bars) is a long-distance strategy, not a quick earning. If the owner of a bar decides to sell it quickly, he might lose 10-15% of its value. Investing in gold is a long game, quick decisions made based on emotions can turn out to be costly,' Lesovyi noted. Since the beginning of 2025, the price of gold has risen by a third. However, the banker considers it unlikely for gold to return as the main measure of money value. The 'gold standard' was abandoned by the world back in the 70s after the USA refused to tie the dollar to gold. This became the most significant event for the global financial system,' he explained. Gold, just like some other currencies that have a reserve currency status, attracts powerful investors aiming to preserve their capital. 'It is important to remember that the Ukrainian currency market is in extraordinary conditions, such as war, and the National Bank remains the main player in the market. Therefore, the exchange rates of the dollar and euro in Ukraine will depend more on the regulator's strategy and monetary policy. The value of the euro will also depend on global dollar rates and the balance of supply and demand,' Lesovyi noted. According to him, the interest of Ukrainians in gold is modest, despite the rise in its value globally. Simply not all banks have sufficient gold reserves, and this affects the difference between the purchase and sale prices of gold. Bars weighing 50-100 grams are the most popular among buyers and account for over 70% of total sales volume. By the end of the year, clients are more actively investing in currency in an attempt to protect their funds from inflation. 'Investment demand is an endless resource, and when one sector temporarily dominates, others may suffer losses,' added the banker.

Read also

- PFU warned women: starting from 2025, this will be insufficient for pension

- One event will determine the exchange rate of the euro and the dollar: expert names the key date in July

- Severe Weather Deterioration: Yellow Level Issued Across Almost the Entire Country

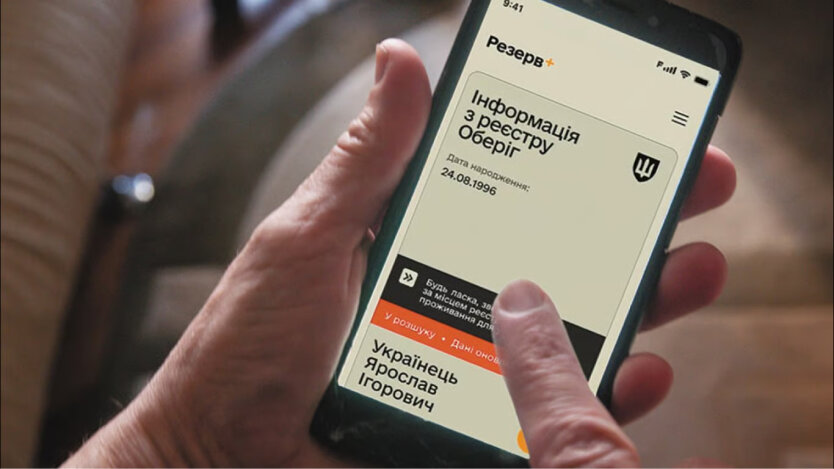

- Lawyers explained how many times the TCC can impose fines for violating military registration

- Touching everyone when trying to exchange 100 dollars: Ukrainians warned about potential problems

- In Ukraine, the secrecy of geological information about strategic minerals has been lifted