What are dividends and how are they paid out.

An important part of earning through investing is dividends. This is a kind of passive income that theoretically everyone can receive. However, many still find it difficult to understand what dividends are and why such payments are made. Moreover, at first glance, this system seems complicated, how to arrange it, how to receive it, how to receive it regularly, and other questions remain a mystery.

At the same Time, understanding what dividend yield is and what it generally entails will be useful for all investors. After all, it is a simple and understandable tool. Understanding what dividend income is allows you to earn while doing literally nothing.

What are dividends and how to receive them?

So, what are dividends in simple terms: they are the company's profit, or rather a part of it, which the company pays to those who purchased its shares earlier (shareholders). In other words, a shareholder receives income simply for owning these shares. Therefore, what dividends mean is a reward for shareholders for timely investing in a particular company's shares. Overall, the company is interested in maintaining cooperation with shareholders for a long time. The size of dividends, in turn, depends on the company’s profit and the decisions made by its management and board of directors.

Dividends, unsurprisingly, come in different types. They depend primarily on the company and the size of the income in question. The main types of dividends that you definitely need to pay attention to are:

-

Dividends in the form of classic money. This is the most popular type, where the payment is made in cash. This allows shareholders to immediately receive financial benefits.

-

Dividends in the form of shares. This is payment in company shares, which increases the shareholder’s stake. Thus, the shareholder can receive more shares instead of cash payments.

-

There is also a separate type of dividends known as natural dividends. This is a rare type of dividend where shareholders receive goods or services from the company. Typically, this type is used by large corporations.

Overall, these are all types of dividends from which one can easily earn.

Who and how pays dividends?

Dividends are not a universal concept. First and foremost, the board of directors of the company (whose shares have become an investment) makes the decision on what payments will be made to shareholders. In general, the approval of dividends has certain stages:

-

First, budget planning is conducted. The board of directors analyzes the company's financial indicators and determines what part of the profit can be allocated for dividend payments.

-

Next, the results of the company's entire performance need to be reviewed. It’s important to take into account not only current indicators but also the projected growth of the company, investment projects, and possible economic risks.

-

Then, shareholders gather. At this meeting, the payment of dividends is approved, including their amount and form.

This is enough to then pay dividends.

How are dividends paid in Ukraine?

In Ukraine, even during wartime, dividends continue to be paid. As everywhere in the world, to receive dividends, shareholders must go through several steps that ensure the legality of their payments and compliance with all formalities. In other words, this process continues. How dividend payments are made in Ukraine:

-

Confirmation of the right to dividends. To receive dividends, one must be a shareholder as of the established cutoff date (the registration date). This is the day when the company finalizes the list of all shareholders who will receive dividends. In Ukraine, companies usually publish information about the cutoff date and the payment date.

-

Next, tax withholding occurs. Income tax is withheld from dividends. In Ukraine, the tax on dividends for individuals is 5%, making dividend income attractive from a tax perspective.

-

After this, the dividends themselves are paid. If it is cash, it is deposited into the shareholder's account. If it is stock dividends, they are added to the number of shares owned by the shareholder.

There is also a set number of days for dividend payments (which must all be paid during this period).

What are the advantages of receiving dividends in Ukraine:

-

Regular income. Shareholders receive stable income, especially when it comes to large companies that pay dividends every year.

-

Such investments are considered among the most stylish. Dividends indicate the company's financial stability, which can increase shareholders' trust.

-

Dividends also allow for capital growth. By reinvesting dividends (in the case of stock dividends), shareholders can increase their stake in the company and gain more benefits in the future.

However, dividends, or rather the process of their accrual, is associated with risks. What we're talking about:

-

Payments, while coming with a certain regularity, do not happen as frequently as shareholders might like. This means that even the term "regularity" does not apply. In some cases, a company may suspend dividend payments if it faces financial difficulties.

-

Such income cannot be stable. Dividends depend on the company's profit, so in years of losses, dividends may not exist.

-

Additionally, due to dividends, there is quite a significant tax burden. In some cases, taxes on dividends may turn out to be higher than expected.

Overall, to consider dividends, one needs to weigh all the pros and cons of such investing, especially in Ukraine in 2024.

A few words should be said about how one can generally find out about a company's dividends:

-

Annual reports. Companies are required to publish financial statements, which usually indicate decisions about dividends.

-

Publications. This refers to official sources of information. Decisions about payments are often published on the official websites of companies.

-

There are also separate platforms for shareholders.

Such sources will be enough to find out when payments will be made.

Read also

- Almost 600 hryvnias per kilogram: the price of a popular product has skyrocketed in Ukraine

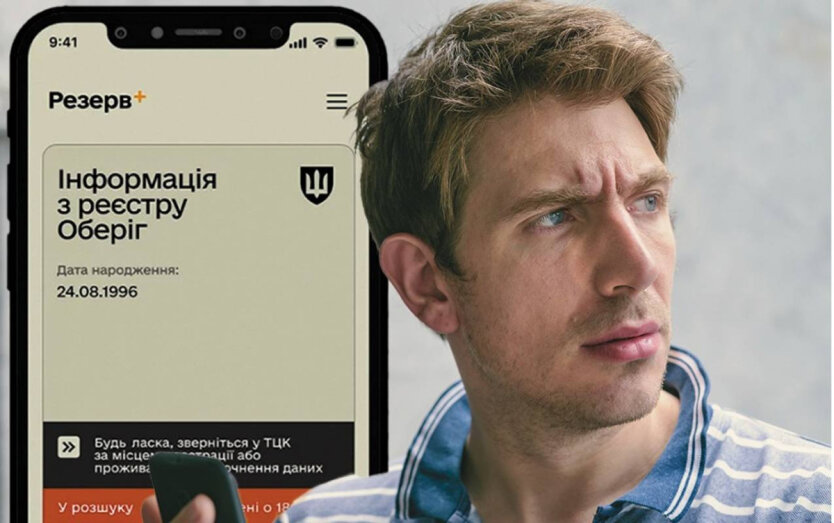

- Ukrainians were explained how the payment of a fine from the TCC in Reserve+ affects removal from the wanted list

- Applicants have only 15 minutes: registration has started with an important condition

- Poisonous plant threatens Ukraine: doctors warned about the consequences

- Gas stations show impressive price range for A-95 in Kyiv: from 53 to 62 hryvnias per liter

- Own business: in which areas do Ukrainians most often open a business