Loans, deposits, dollar and euro exchange rates: what 'maneuvers' to expect from banks in September.

10.09.2024

2026

Journalist

Shostal Oleksandr

10.09.2024

2026

With the onset of autumn, business activity in Ukraine is increasing. The financial sector is preparing for the new season by adjusting its services according to economic realities. Inflation has been rising since the beginning of summer. The National Bank of Ukraine predicts an increase in consumer prices by the end of the year. Banks are not in a hurry to reduce interest rates on loans, but competition for large clients remains high. Small and medium-sized businesses can expect higher rates. Government support programs for businesses maintain loan rates. The banking system has excess liquidity, allowing financial institutions not to actively attract clients. It is forecasted that banks will intensify their work with the population regarding the sale of bonds and strengthen their work with legal entities. Demand for currency remains high, and banks are actively earning on currency operations. The launch of the 'National Cashback' program in the card business is expected in September. The financial performance of banks depends on the specifics of their work, and plans to raise additional funds for the budget include cost reduction, additional bond issuance, and other measures. The banking sector demonstrates flexibility and adaptability to economic conditions, offering clients various financial instruments and services that correspond to the current situation in the country.

Read also

- State Assistance: What Benefits Wives of Combatants Are Entitled to in Ukraine

- Energoatom prepares power units for maximum operation in winter

- Record results of NMT: an unexpected leader among subjects named

- This will be the case: cardholders warned about the inevitable

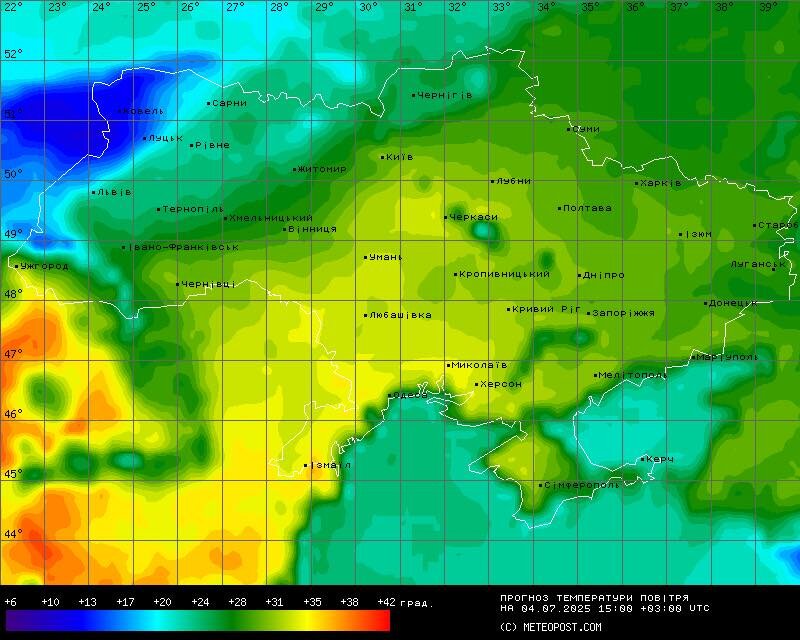

- Weather to hit well-being: Didenko warned Ukrainians about the danger

- The Cost of Seasonal Vegetables: Analysts Compared Prices for Cucumbers and Tomatoes in Major Retail Chains