German Bundesbank reported record losses.

The German Bundesbank has incurred record losses of 19.2 billion euros in 2024 due to the European Central Bank's (ECB) interest rate policy. Over the last four years, the federal budget has not received any revenue. These losses were previously offset by reserves, but this year it was impossible. According to Bundesbank estimates, the coming years will also be unprofitable, but the losses will be smaller. In 2024, the Bundesbank has only 0.7 billion euros in reserves left to mitigate losses. Although the result improved compared to last year, it is still negative.

Since the summer of 2022, the ECB unexpectedly raised interest rates to combat inflation. Then, inflation levels came under control, and the ECB lowered the benchmark rates in the eurozone. High interest rates in financial markets led to increased costs for central banks like the Bundesbank, which struggled to catch up with interest income. Additionally, many long-term securities, such as government and corporate bonds, yielded low interest.

Read also

- Russians are trying to completely destroy Chasiv Yar with barrel artillery - OSA 'Luhansk'

- The Sumy Regional Military Administration denied information about a possible evacuation of the city

- The General Staff responded to Russia's statement about a breakthrough in Dnipropetrovsk

- Ukrainians warned about a new massive attack from the Russian Federation: Kyiv and 8 other regions at risk

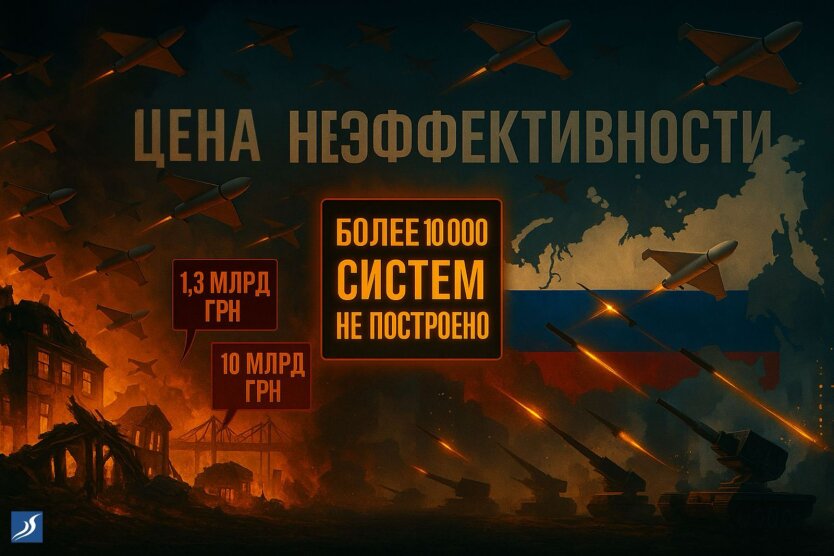

- The Cost of Inefficiency: Large-Scale Russian Attacks Require Large-Scale Organizational Responses from Ukraine

- War may come to us: the head of the Czech Republic issued a troubling warning