NBU raised the rate to 14.5%: what will change for depositors and borrowers.

The National Bank of Ukraine has published the results of its information campaign aimed at explaining important economic and financial processes in the country.

In a series of analytical articles, the regulator detailed the impact of its decisions on the financial market and the economy in the context of military conflict.

'We strive to ensure maximum transparency of our actions and decisions so that citizens and businesses have a clear understanding of the processes in the economy,' - the NBU stated.

Increase in the discount rate and currency liberalization

In December 2024, the NBU increased the discount rate to 13.5%, and in January 2025 - to 14.5%. The regulator explained in detail how this decision will affect inflation, the yield of bank deposits, and the overall state of the country's economy.

Particular attention is paid to the issue of currency liberalization. During 2024, the National Bank significantly eased currency restrictions for businesses in accordance with the approved Strategy, explaining the relevance of this task even during wartime.

The publications also discuss the issue of increasing the volume of currency sales by the National Bank in 2024 compared to the previous year. The NBU explains the role of international aid and the growth of state budget expenditures in this process, emphasizing that these changes pose no threat to the currency market.

The growth in demand for cash currency in 2024 is related to the lifting of restrictions on its sale by banks at the end of 2023. Until December 2023, banks could sell only a limited amount of cash currency, and now such restrictions have been removed.

Analysis of managed flexibility of the hryvnia exchange rate

A series of publications concludes with an analysis of the managed flexibility regime of the hryvnia exchange rate currently in effect in Ukraine. The NBU assesses the effectiveness of this policy in the context of reducing the accumulation of economic imbalances.

Read also

- The Pension Fund of Ukraine explained the procedure for appealing dubious sick leave certificates

- Error in PFU documents: Ukrainians were told how to correct data without leaving home

- Forecasters have predicted whether March in Ukraine will be warm and sunny

- Expensive repair due to a single mistake that drivers are not even aware of

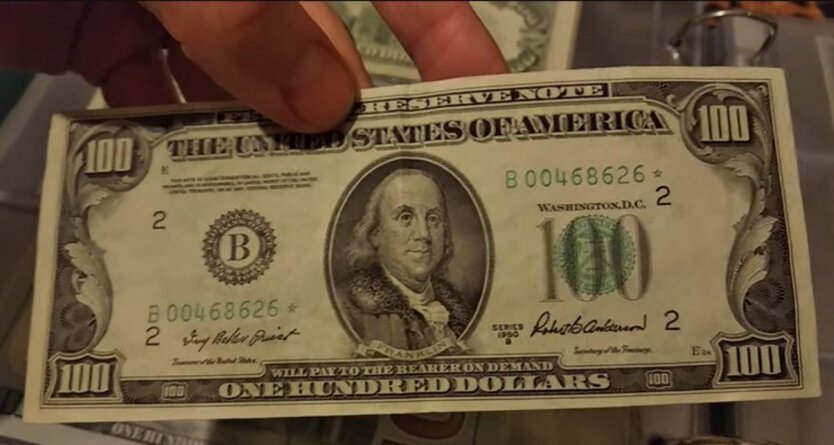

- Touching all when exchanging a hundred dollars: Ukrainians warned about possible problems

- Pension Fund Explains Why Military Personnel May Lose Pension Supplements