Group 1 of individual entrepreneurs types of activities 2024.

All entrepreneurs in Ukraine must operate legally. This applies to all citizens who earn regular income within certain legally established limits.

Therefore, it is always necessary to understand how this works and who should become what type of individual entrepreneur. First and foremost, this concerns the types of activities for individual entrepreneurs of group 1. Besides monetary restrictions, there are also specific conditions regarding activities. Overall, the types of activities for group 1 individual entrepreneurs are a decisive criterion. Moreover, group 1 is one of the most common.

Types of Activities for Individual Entrepreneurs of Group 1

Let’s start with who individual entrepreneurs are. These are individuals who conduct legal activities in Ukraine. The first group usually concerns small and medium-sized businesses. It is they who use this type of individual entrepreneurship. Additionally, this group has one of the simplest registration processes and subsequent tax payments.

In 2024, group 1 individual entrepreneurs remain a good option for small businesses. At the same Time, it is always important to remember that the types of activities for group 1 individual entrepreneurs in 2024 are strictly regulated.

Types of Activities for Individual Entrepreneurs of Group 1

The first group of individual entrepreneurs is intended for those who run small businesses with minimal turnover and do not employ hired workers. This means that such a type of activity implies earnings "for oneself," but at the same time, one cannot hire other citizens. Individual entrepreneurs of group 1 have the lowest tax burden and simplified accounting, making them attractive for certain categories of business.

Let's start with what limits exist for this group. Income restrictions determine the amount of tax. As of 2024, this restriction is 1,185,700 UAH. This amount was changed this year.

Additionally, individual entrepreneurs of group 1 cannot hire other citizens. That is, no matter how big the business is, it cannot attract new employees under group 1. There are also limitations on the type of activity, which is more significant. Among the advantages for this group is simplified accounting, which allows virtually any citizen to manage it.

A few words should be said about the advantages of the first group of individual entrepreneurs:

-

Minimal tax burden: 10% of the minimum wage.

-

Simple reporting system.

-

Use of cash registers (RRO) is not mandatory for most types of activities.

Thanks to all these conditions, the first group of individual entrepreneurs is one of the most widespread in Ukraine.

Who Can Register as an Individual Entrepreneur of Group 1?

Group 1 individual entrepreneurs are suitable for those engaged in retail trading at markets or providing household services to the population. These are individuals whose activities are local and small in nature. For example, such entrepreneurs can sell products at markets, in small retail outlets, or provide services that do not require complex manufacturing processes. However, no matter how much an entrepreneur desires, they may not always be able to become an individual entrepreneur of group 1.

What are the requirements for this group:

-

The activity must be related to retail trading or providing household services.

-

There should be no need to employ hired workers.

Since this group has a simplified taxation system, it also has its limitations. What are the limitations for group 1 individual entrepreneurs in Ukraine:

-

Such entrepreneurs cannot engage in activities related to providing services to other entrepreneurs and legal entities.

-

Wholesale trading and activities in the catering sector are also not allowed (except for small kiosks and market trading).

There are no other serious restrictions for this group.

Types of Activities for Individual Entrepreneurs of Group 1 in 2024

The main condition for becoming an individual entrepreneur of group 1 is the type of activity. In Ukraine, there are specific conditions and a list of such activities. First of all, it is retail trade. This is one of the main types of activity for group 1 individual entrepreneurs. Entrepreneurs can trade at markets and in small retail outlets, selling products to the population. However, it is important to note that wholesale trading of goods is prohibited.

What can be done under this group (what to sell):

-

Food products.

-

Clothing and footwear.

-

Household goods.

-

Cosmetics and perfumes.

-

Stationery.

Under group 1, household services can also be provided to the population. Providing household services is also one of the key areas of activity for group 1 individual entrepreneurs. This category includes various types of services aimed at individuals. For example, there are hairdressing services, clothing repairs, carpet cleaning, and tailoring services.

Group 1 can also engage in the production and sale of handmade products. Handyman artisans who produce and sell their own goods (jewelry, accessories, decorative items) can also work in group 1. It is important that the sale takes place in a retail format, such as at markets or in small shops. There is also mention of small services in the construction sector.

Read also

- New Opportunity for Entrepreneurs: PrivatBank Simplified Key Procedure

- Transition from dollar to euro: NBU names timelines, and IMF - conditions

- Not only tax: who else will gain access to the banking secrets of Ukrainians

- Blood group linked to early stroke risk: study results

- Zelensky confirmed the death of the commander of the 110th Mechanized Brigade, Zakharievich, as a result of a missile strike

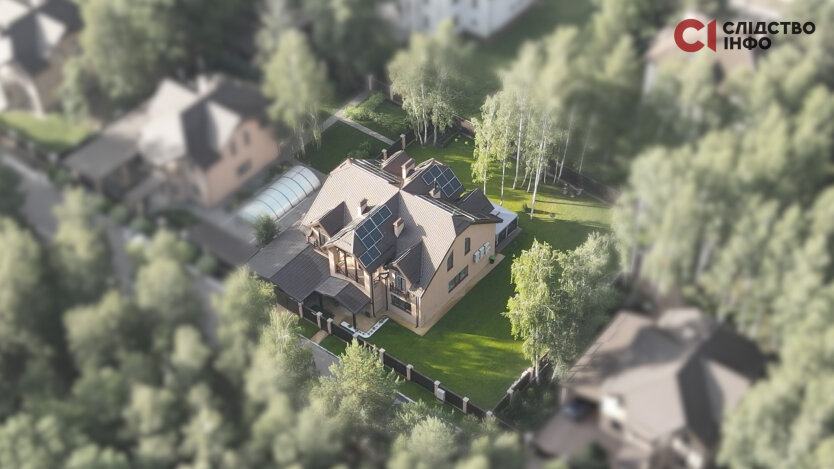

- The former head of the Brovary TCC was found to own elite real estate and a fleet of vehicles