What will happen if you do not pay the loan.

Lending may be a convenient system, but it doesn't always function flawlessly. It's often the case that a client doesn't repay the loan. In this situation, one has to consider what will happen if they don't pay the loan. That is, the situation of taking a loan and not paying occurs quite frequently, and in this case, it's important to understand what will happen and what to do next.

Clients who take out large loans also need to consider what will happen if they don’t pay. It can be difficult for them to make payments on Time, and sometimes they may not have paid at all. In all these situations, there are solutions.

What to do if you can’t pay the loan?

The lending system is quite straightforward. A client borrows money and pays a certain percentage each month for not having repaid the money yet. The system is clear and transparent, especially if one is taking a loan from a reputable bank. However, the regularity of payments (percentages) can become the problem that is rarely discussed.

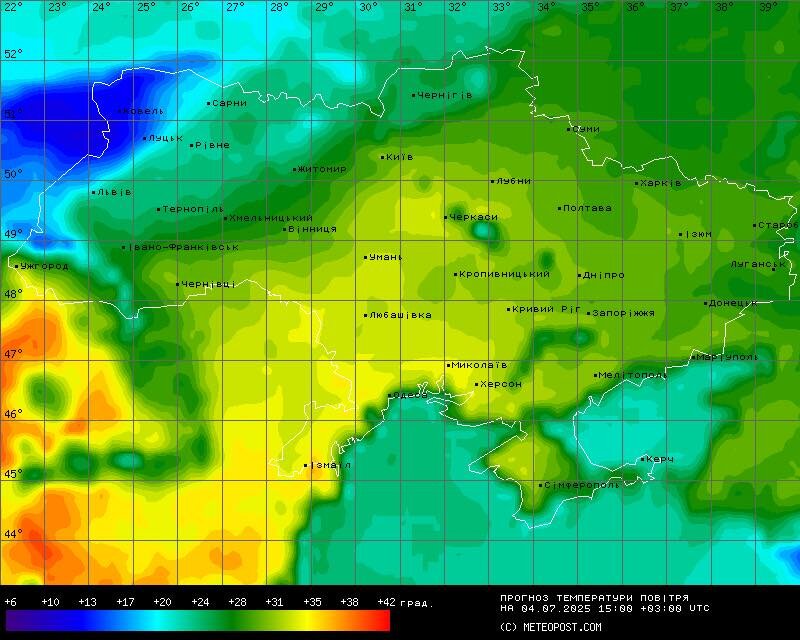

In 2024, Ukraine is seeing a tightening of measures aimed at combating debtors. Failure to pay a loan on time can lead to unpleasant consequences for the borrower's financial position and future opportunities. Therefore, the question of what to do if one fails to repay a loan on time is incredibly important. After all, it’s possible not only to accumulate even more debt but also to suffer serious losses.

The first thing that comes to mind if you don't pay your loan on time is that there will be fines. The most obvious consequence of failing to repay a loan is the imposition of fines and penalties. In 2024, Ukrainian banks and microfinance organizations continue to actively impose punitive measures in the event of payment delays. Fines can vary, but the client is informed of them in advance. There is a penalty for each day. This is one of the most complicated financial punishments. It usually constitutes a certain percentage of the overdue payment amount. The longer the borrower fails to repay the loan, the higher the penalties that accumulate.

The second type of fine is simpler. It is a one-time fine payment. Some financial institutions immediately impose a fixed fine for the first delay, which can amount to several thousand hryvnias, depending on the terms of the contract. That is, missing mandatory payments can become a serious problem. The absence of a solution to this problem only exacerbates everything.

What will happen if you don’t pay the loan?

A second significant sanction could be a deterioration in credit history. Thus, a client can tarnish their reputation. At first, the sanction may not seem serious, but in reality, it is very dangerous. In the future, if needed, the bank will not grant a loan.

All Ukrainian banks and microfinance organizations transmit payment data to the Ukrainian Credit History Bureau (UCHK). If a loan is not repaid on time, this information is recorded in the bureau and is made available to all financial institutions.

If the credit history is already damaged, the client's rating is automatically lowered. This can complicate obtaining new loans in the future. In the future, it is almost certain that the client will be denied a loan. Even when applying to other banks or microfinance organizations, the borrower may be denied a loan due to a poor credit history.

If the loan is granted in the future, the client will definitely have worse conditions. For example, a higher interest rate or a shorter grace period. If we talk about unpleasant situations, the bank may frequently call and message. If a loan payment is overdue by several days or weeks, the bank or microfinance organization will start actively reminding the borrower about the debt. It seems minor, but it can significantly affect a person’s psycho-emotional state. Besides calls, clients and their borrowers are bombarded with letters. These can come not only to the registered address but also to the place of work.

One of the worst scenarios awaiting a debtor is the sale of the debt to collectors. If the borrower continues to ignore their credit obligations, the bank may transfer their debt to collection agencies. In 2024, a law regulating collector activities is in effect in Ukraine; however, their work still raises many discussions. It is important to understand that, after the debt is transferred to collectors, communication with them can be much less pleasant than with the bank. In reality, the collector uses moral pressure that not everyone can cope with.

How collectors behave:

-

They call far more actively than bank employees. That means it can happen frequently and even at night.

-

They may also try to contact the debtor's relatives and colleagues. That is, they pressure the debtor through their close circle, damaging their reputation.

-

Collectors may come to the debtor's registered address. This is one of the most unpleasant consequences of being in debt. Quite often, collectors may try to meet the debtor in person to discuss the repayment conditions.

However, it is important to remember that in 2024, legislation regulating the actions of collectors is in force in Ukraine. For example, they cannot violate human rights, threaten physical harm, or invade privacy. In reality, these rights are often violated, so it is not worth relying on collectors.

Legal disputes and property confiscation

Even a small debt accumulates over time. Little by little, the total amount grows. Meanwhile, the borrower does not pay. Then the bank may decide to sue the debtor. In Ukraine, this process is quite common and can take several months. It is important to understand that litigation will not only increase the debt due to legal expenses but may also lead to the forced seizure of property. Overall, this is also a very unpleasant situation.

After the filing of the claim and legal proceedings, the court issues a verdict. If the borrower has indeed failed to fulfill their obligations, the court will rule in favor of the bank. If the borrower continues to ignore the court's decision, their debt may begin to be collected forcibly through the enforcement service.

Read also

- Energoatom prepares power units for maximum operation in winter

- Record results of NMT: an unexpected leader among subjects named

- This will be the case: cardholders warned about the inevitable

- Weather to hit well-being: Didenko warned Ukrainians about the danger

- The Cost of Seasonal Vegetables: Analysts Compared Prices for Cucumbers and Tomatoes in Major Retail Chains

- Euro reaches 50 hryvnias: Ukrainians named the limit until the end of the year