What is financial analysis in simple words.

The world of finance is very diverse and interesting. Financial analysis is also important, as it allows one to assess their earnings. Understanding what financial analysis is can be beneficial for all investors and, in general, for entrepreneurs.

In understanding what it is, it is also important to know how to properly conduct such an analysis. In simple terms, it is analytics that will be useful for any entrepreneur.

What is financial analysis?

Financial analysis has many common aspects with any other analysis. It is a tool that every entrepreneur can use. Through analysis, one can assess the status (prospects) of a company. Besides companies, such an analysis will be useful for organizations and individuals. Anyone wishing to evaluate performance and profitability. It is a set of methods aimed at evaluating financial data to determine how effectively assets are managed and to identify potential risks.

For businesses in Ukraine in 2024, financial analysis becomes particularly relevant. Given the current economic situation, fluctuations in the currency market, and inflation, companies and private entrepreneurs must carefully monitor their financial position to avoid losses and maintain stability. Thus, analysis has become more of a necessity rather than just an additional option.

What do you need to know about financial analysis?

This type of analysis, which has existed for quite some Time, has its clear objectives. What it is about:

-

The analysis allows you to assess the current financial position. The analysis helps to understand the state of the finances of the company or individual.

-

Also, through analysis, one can determine both strengths and weaknesses of the company's operations. It identifies areas where the company is successful and areas that require improvement.

-

Additionally, the analysis can assess risks (potential). It helps to identify potential threats to the business, for example, a high level of debt or unstable income.

-

Furthermore, if an analysis is conducted, it is possible to forecast the future of the company, organization, or individual’s activities. Based on the analysis, forecasts can be made for the future, which is important for planning.

-

If the analysis is used correctly, it can optimize resource utilization. The analysis helps improve resource allocation to reduce costs and increase profits.

There are enough tasks for financial analysis to still be considered highly effective.

What types of financial analysis can be used?

Thus, financial analysis can take different forms (due to the large number of different tasks). Which of these types are the most popular:

-

The most common type still in use is vertical analysis. It involves comparing indicators within one report. For example, when considering the income statement, one can see what share net profit, cost of goods sold, tax expenses, etc., have. This analysis helps understand the structure of the company's income and expenses and find possible ways for optimization.

-

Its opposite can be considered horizontal analysis. This allows for comparing data over different periods, for example, the current year and the previous year. This way, one can see how indicators have changed and analyze the reasons for these changes. For businesses in Ukraine, this approach is important to track the influence of economic conditions and inflation on financial indicators.

-

Separate analysis is conducted on ratios. Ratio analysis includes calculating various financial indicators such as liquidity, profitability, and financial stability. Ratios provide objective data on how financially stable a company is.

-

There is also cash flow analysis. This studies the movement of cash within a company. It allows understanding how cash comes in and goes out of the company. This analysis is important to ensure that the company does not find itself in a liquidity deficit situation.

Each of these types of analysis has its characteristics and some drawbacks.

How is financial analysis conducted?

Financial analysis has its stages. Regardless of the type of analysis itself, these stages are universal:

-

First, it is essential to collect data. This means gathering all financial reports: balance sheet, income statement, cash flow statement, etc. This is the foundation for the analysis.

-

Next, it is necessary to understand what the analysis's goal is. Perhaps it is an assessment of financial health before attracting investments or planning business expansion.

-

Then, one must choose the method of analysis. Depending on the objectives of the analysis, a method is selected. For example, to assess debt load, ratio analysis is suitable, while for a general picture — vertical and horizontal analyses.

-

The actual data analysis occurs. At this stage, calculations and interpretation of data are conducted. For instance, if the share of debt obligations constitutes a significant portion of assets, this may indicate a high level of risk.

At the end of each analysis, conclusions should be drawn. Recommendations may also be formulated. After the analysis, it is important to make conclusions that will help improve financial conditions. For example, if a high share of expenses is discovered, measures can be suggested to reduce them.

However, during this analysis, common mistakes may occur. What it is about:

-

Excluding the impact of external factors on the results of specific activities. In other words, it would be a mistake not to consider the economic situation in Ukraine, especially important in 2024 when the country’s economy may undergo various changes.

-

Also, one should not conduct analysis based on incomplete data. Analysis based on incomplete or outdated data may lead to erroneous conclusions.

-

Moreover, numbers alone are not enough. It is important to understand not only figures but also the reasons behind them. Numbers can show results, but interpretation helps understand the causes.

By avoiding at least these mistakes, it will be possible to conduct a relatively objective and truthful analysis.

Read also

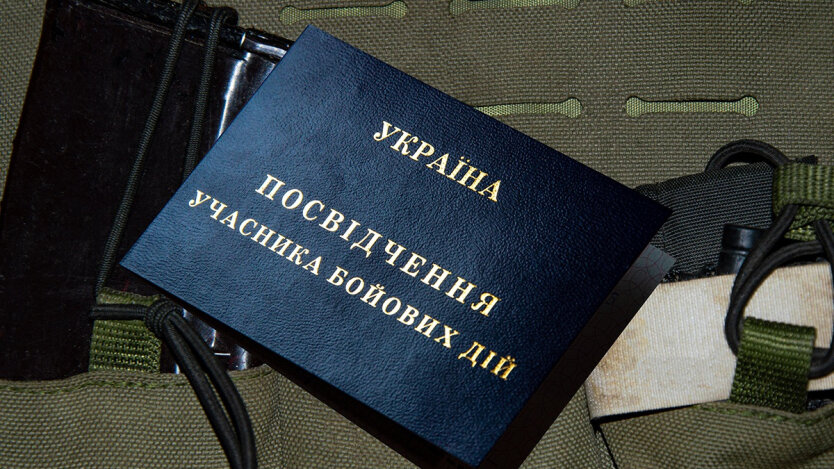

- State Assistance: What Benefits Wives of Combatants Are Entitled to in Ukraine

- Energoatom prepares power units for maximum operation in winter

- Record results of NMT: an unexpected leader among subjects named

- This will be the case: cardholders warned about the inevitable

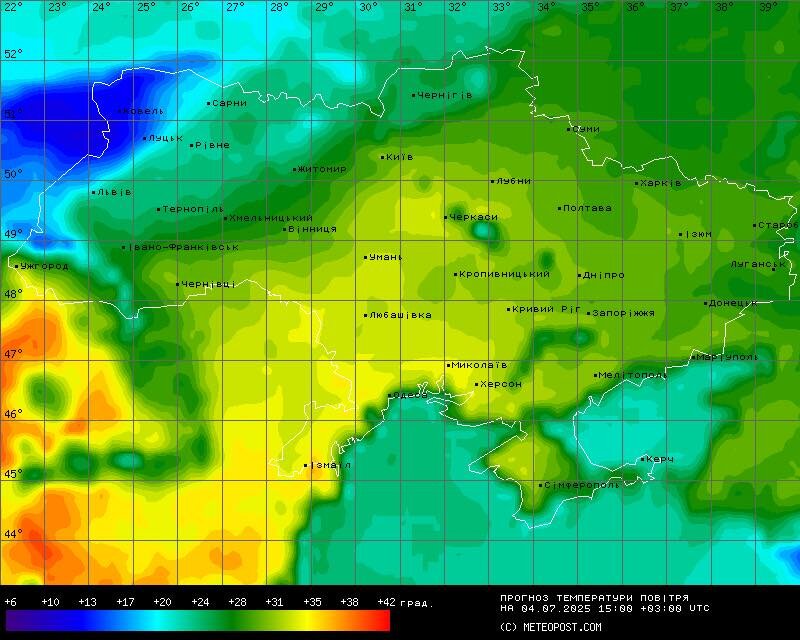

- Weather to hit well-being: Didenko warned Ukrainians about the danger

- The Cost of Seasonal Vegetables: Analysts Compared Prices for Cucumbers and Tomatoes in Major Retail Chains