What is leverage in simple terms.

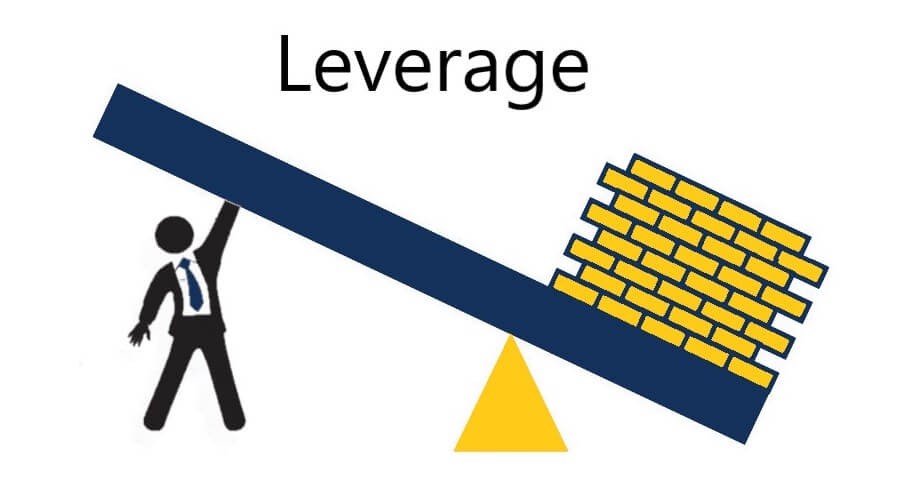

Generating profit always remains a priority for all businesses. This is also associated with many different terms. For example, leverage. Essentially, it is a lever that allows you to earn and make a profit as quickly as possible.

Leverage what is it: in simple terms, it is a financial lever with which you can make transactions for amounts exceeding your own capital. Leverage is also a tool that newcomers need to learn (at least for beginners).

What is leverage?

So, this is not just a convenient tool, it is a lever for business and various investments. Leverage is actively used in business, investing, and trading in financial markets. In the context of the Ukrainian economy in 2024, where access to external financing is often limited, understanding this tool is particularly relevant.

To understand what this tool is, you need to analyze a simple example. There is money for investment. An assumed 1000. With leverage at a ratio of 1:10, you can operate with a sum of 10,000 dollars, where 9,000 is provided as borrowed funds. That is, these are both the money that is invested and a small base for a loan. If the investment brings profit, the yield will be significantly higher than if you used only your own money. However, in the case of a loss, you will also incur significant losses, which makes leverage a tool with increased risks.

It should be noted right away that leverage, while convenient, is not always an ideal mechanism. This fact should be taken into account. There are also additional terms that will help understand leverage. For example, the leverage ratio. It is a coefficient that can show how many times borrowed funds exceed your own capital. For example, a leverage ratio of 1:10 means that for every dollar you have, you receive 9 borrowed dollars. It should also be mentioned that there is margin. This is the amount of your own funds that you need to invest in order to use leverage. For completeness, it should also be mentioned that there is a margin call situation — this is when, due to losses, your capital becomes insufficient to maintain an open deal, and the broker requires you to deposit additional funds or closes positions.

Advantages of using such a tool

So, leverage has its advantages that need to be considered right away. This includes:

-

Potential increase in profits. Using borrowed funds allows for greater earnings in successful investments. For example, with a leverage ratio of 1:10, even a small price increase on an asset can bring significant profit.

-

Leverage also allows access to large investments. Leverage enables participation in deals that would be unavailable when using only your own capital.

-

This tool provides flexibility when it is necessary to manage your own funds correctly. You can distribute your investments among different assets, minimizing risks.

-

Also, this tool is quite simple to use. In financial markets such as Forex or stock exchanges, brokers provide leverage, making it available even for beginners.

However, it is important not to forget about the risks. What are we talking about:

-

Losses can increase. As leverage amplifies profit, it also amplifies losses. If the price of an asset moves against you, you may lose significantly more than you invested.

-

Do not forget about the so-called margin call. In case of significant losses, the broker may close your positions or require you to replenish your account, which creates additional financial pressure.

-

Managing risks in such conditions is also difficult. Working with large sums requires high discipline and understanding of market mechanisms; otherwise, one can quickly lose capital.

Therefore, before using such a tool, you need to weigh all the risks.

Where and how can leverage be applied?

This tool has many ways to be utilized. First of all, it is the financial markets. In Ukraine, the popularity of trading on Forex and the stock market is growing. Brokers offer various levels of leverage, which makes this market accessible to a wide audience.

Leverage is also used in real estate investing. Purchasing residential or commercial property using a mortgage is also an example of leverage. You use borrowed funds to acquire an asset that is expected to increase in value.

Such a tool will also come in handy in business. Companies often take loans to expand their operations, seize new opportunities, or implement technologies.

What are the forecasts for leverage in Ukraine in 2024?

In 2024, the situation in Ukraine is not the easiest. This needs to be taken into account if you want to use leverage. How is this tool doing in Ukraine:

-

It is an ideal tool for business (this has remained constant). The restoration of infrastructure and the economy requires significant investments. Companies are actively using borrowed funds to finance new projects.

-

Private investors are also still using this tool. Against the backdrop of the instability of the hryvnia, many Ukrainians are looking for opportunities to invest in foreign assets, shares, or gold. Leverage allows them to participate in these markets even with limited capital.

-

For working on financial markets, leverage remains a sought-after tool in Ukraine in 2024. The popularity of online trading platforms continues to grow. Many Ukrainians are trying their hand at trading using leverage.

Overall, in any case, leverage should become a safe tool. And this fact should be taken into account. For example, it is important to determine the risks right away. Never risk more than you are willing to lose. It is essential to immediately study the market. Before using leverage, it is crucial to understand the characteristics of the chosen asset and market. It is important to get into the habit of controlling the amount of borrowed funds. Do not use maximum leverage, especially if you are a beginner. In any case, you need to manage your portfolio.

Read also

- What is MoneyGram in simple words

- What is needed for transferring and receiving money via Western Union

- What is Western Union in simple words

- Who is an acquirer in simple terms

- Who is an issuer in simple terms

- What is emission in simple terms