Who is an acquirer in simple terms.

Payment for services or goods has long become an accessible option, especially online. Therefore, almost all entrepreneurs need to understand who an acquirer is and how an acquirer works as a whole.

It is better to immediately figure out what an acquirer is and how it works in simple terms. After that, this function can be used to simplify the entire process of trade or service provision.

What is an acquirer?

Let's start with the fact that this is a financial service. It is usually used by businesses to accept payments. Such payment can be made for services or goods. A bank card is necessarily used for this process. The company that provides this service is called an acquirer. The acquirer plays an important role in cashless payment processes, making them fast, secure, and convenient for clients and businesses.

Acquiring, in general, is a well-established and accessible process. It includes payment processing. With its help, a large number of payments are carried out all over the world. What it is about:

-

With its help, you can receive payment by bank card. This can be a physical card, a smartphone with NFC, or online payment on a website.

-

Next, all data is transmitted to the processing center. The acquirer is responsible for the technical processing of payments.

-

After that, money is withdrawn from the client's account. After successful verification, data is sent to the client's bank.

-

Then the business receives these funds into their account. Money is credited to the seller's settlement account after deducting the commission.

However, the client does not wait for all the processes to go through; they do not even notice them, as this is a very quick procedure.

In this process, the acquirer is a bank or financial organization that provides acquiring services. It has its own clear and mandatory functions. What it is about:

-

It must provide all necessary equipment. The acquirer installs POS terminals or provides online solutions for accepting payments.

-

It is also responsible for transaction processing. It handles the transmission and verification of payment data.

-

It ensures the security of the entire process. Acquirers implement security technologies such as 3D-Secure, data encryption, and tokenization.

-

The acquirer takes care of servicing all clients, whatever issues may arise. This includes technical support and assistance in resolving issues.

In general, the entire system is quite widespread and understandable.

How does the entire acquiring process happen?

Acquiring has many stages, but they all pass quickly, and for the client, it takes literally a minute. So, what are the mandatory stages:

-

First, the client makes a payment. In a store, this happens through a POS terminal. In an online context, it occurs through a payment form on the website.

-

The terminal or website sends the data to the acquirer. The data in question includes the payment amount and all necessary information about the card.

-

The acquirer sends a request to the processing center. This means checking the client's balance and then authorizing the payment.

-

Next, the payment is confirmed. Funds are reserved in the client's account. A confirmation is sent to the seller.

-

Finally, the money is credited to the seller's account, usually within 1-3 business days.

This sequence of stages is the same for all transactions, regardless of the amount.

What types of acquiring are there?

So, this process is simple, but it has its own types. They differ for various types of businesses. It is also important to mention that each type of acquiring has its areas of application in Ukraine:

-

For retail. Used in offline stores. Involves the installation of POS terminals.

-

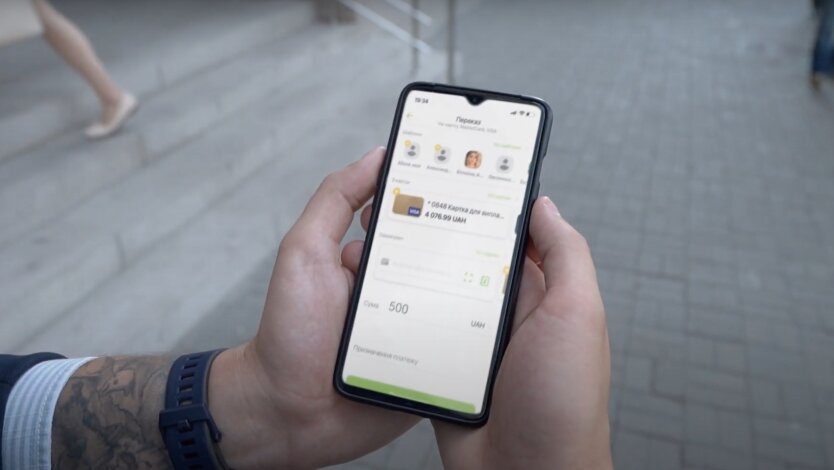

For internet payments. For online stores and services. Connected via payment gateways.

-

For mobile phones. Uses smartphones or tablets with a specific application. Requires connecting a special card reader.

-

QR acquiring. Allows clients to pay by scanning a QR code. Popular among small businesses.

Each of these types has its own advantages.

Why is acquiring needed in Ukraine?

In 2025, cashless payments will account for more than 60% of all operations in Ukraine. Acquiring helps businesses meet modern standards and attract more clients. It has its clear advantages:

-

This is a convenient method for clients. The ability to pay by card, phone, or online.

-

This significantly increases sales volume. Buyers are more likely to make spontaneous purchases when they can pay by card.

-

This method is quite safe. Cashless payments minimize the risk of cash theft.

It is important to remember that this method also automates accounting well. All payments are recorded in the system, simplifying bookkeeping.

A few words should also be said about popular acquirers in Ukraine. Who they are:

-

PrivatBank. Market leader offering retail and internet acquiring.

-

Oschadbank. Focused on small and medium-sized businesses, offering favorable rates.

-

Monobank. Offers modern solutions for online stores.

-

GlobalPay. Provides services for large retailers and small businesses.

-

WayForPay. Specializes in internet acquiring.

You can choose any type of acquiring. However, each bank may have its own clear and accessible conditions. When choosing an acquirer, it is important to consider the following criteria:

-

Rates. This includes transaction fees and the cost of equipment installation.

-

Reliability. The company's reputation and the speed of fund crediting.

-

Technical support. Availability in 24/7 mode.

-

Compatibility. This concerns support for all popular payment systems.

-

Additional services. This involves sales analytics and CRM integration.

Comparing all these conditions allows you to choose a good option for yourself.

In general, acquiring is an important tool for businesses striving to meet the demands of the modern market. In Ukraine, acquiring services are actively developing, offering businesses accessible and reliable solutions. When choosing an acquirer, it is important to consider your needs and the specifics of your operations to maximize the use of this service.

Read also

- What is MoneyGram in simple words

- What is needed for transferring and receiving money via Western Union

- What is Western Union in simple words

- Who is an issuer in simple terms

- Is it possible to send money by mail abroad

- How to Check the State and Status of a SWIFT Transfer