Oil prices sharply dropped after Netanyahu's statement.

Oil prices remain at a low level after two previous declines, as markets consider a potential ceasefire between Israel and "Hezbollah" and an increase in OPEC+ oil supplies with a possible reduction in US fuel stocks.

Brent oil prices increased by 38 cents, or by 0.5%, to $71.50 per barrel. US West Texas Intermediate oil prices rose by 43 cents, or by 0.6%, to $67.64 per barrel, enkorr reports.

As Reuters reports, oil prices fell for the second consecutive day after an Axios reporter noted that Israeli Prime Minister Benjamin Netanyahu would hold a meeting with ministers and heads of military and intelligence services to discuss a diplomatic resolution to the conflict in Lebanon.

According to Axios, Israeli and American officials stated that a ceasefire agreement between Israel and "Hezbollah" could be reached within a few weeks.

"The strong decline in oil prices since the beginning of the week could lead to attempts at market stabilization, but the overall profit will be limited, as there are no catalysts for sustained price growth," said IG market strategist Yeap Jun Rong in a letter.

"A ceasefire agreement in the Middle East reduces the risks of further escalation, which could affect oil production, while OPEC+ still refuses to cut production," he added.

OPEC+ plans to increase oil production by 180,000 barrels per day in December. Overall, the group has reduced production by 5.86 million barrels per day, which is approximately 5.7% of global oil demand.

Comments on the oil markets are again turning to OPEC, considering the planned production increase from December, as well as weak demand in China, analysts at ANZ reported.

However, crude oil and fuel inventories in the US decreased last week, according to the American Petroleum Institute data, market sources report.

Crude oil inventories fell by 573,000 barrels during the week ending October 25. Gasoline stocks decreased by 282,000 barrels, and distillate stocks by 1.46 million barrels.

Nine analysts polled by Reuters expected an increase in crude oil inventories by 2.2 million barrels.

Read also

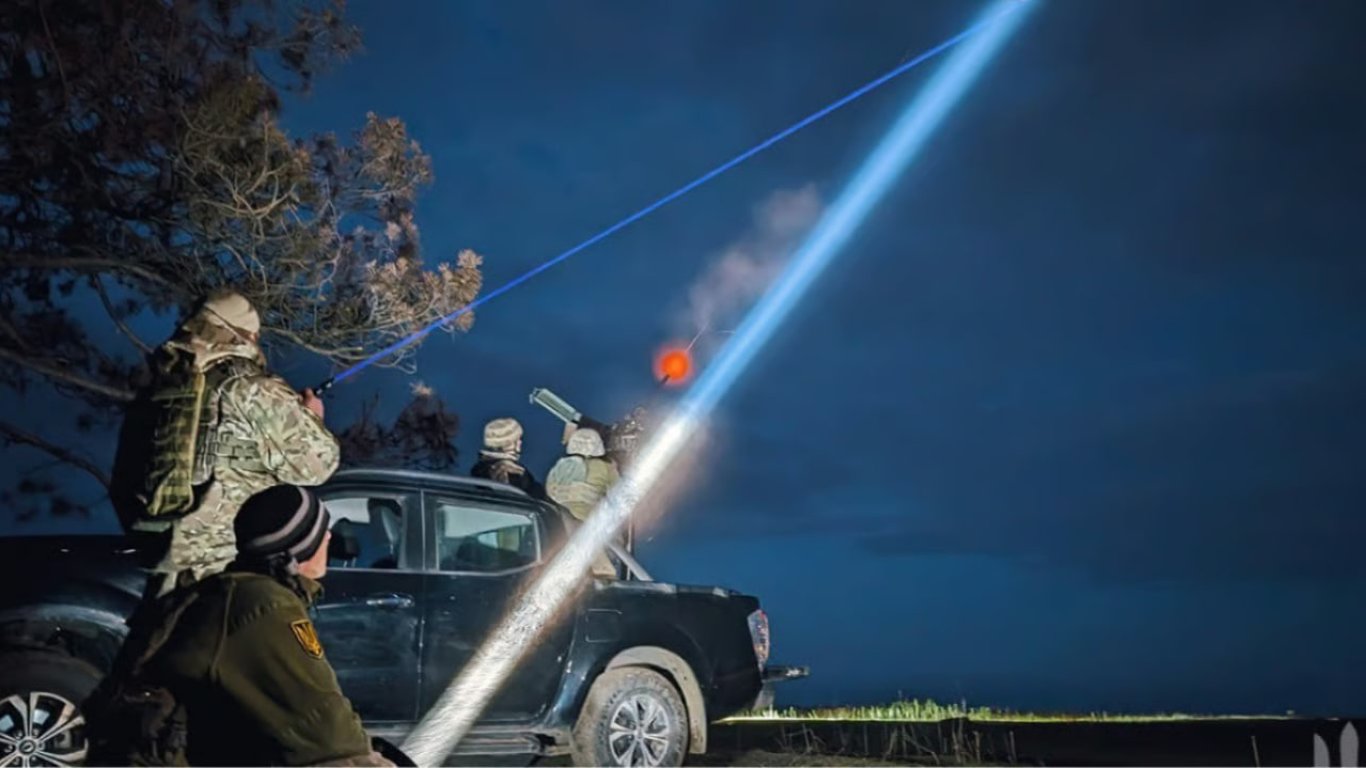

- Kalibrs at Sea - Military Report on the Deployment of Russian Ships

- Payments to the Armed Forces of Ukraine - who can receive financial assistance in July

- Russia attacked Ukraine with drones - how many were shot down by air defense forces

- Partisans 'Atesh' blew up the vehicle of Kadyrovites in Mariupol

- Russian troops attacked two areas of Dnipropetrovsk region - one wounded

- In Khmelnytskyi region, a man leaked information about the activities of the TCC - what punishment