What Determines the Euro Exchange Rate in Simple Words.

The dollar rate and the euro rate, as practice shows, can change sharply and significantly. It seemed that this process is quite spontaneous, but in fact, it is preceded by a number of factors.

When exploring the question of what affects the euro exchange rate, it is worth considering each of these factors. After all, the price of one currency inevitably affects the exchange rate of another (the euro and the dollar are linked).

What the Euro Depends On: Simple Explanation of the Complex

In light of the instability of the economic situation in the world, literally everyone needs to understand what leads to the rise or fall of the euro. After all, the entire system is much deeper than just the price of 100 euros.

What determines the euro exchange rate in simple words: the euro exchange rate depends on several key factors that can be predicted or even tracked. The key in this context is the combination of factors, although one of them would be enough for the rate to start "jumping."

So, conditionally, what affects the growth of the euro:

-

The economic situation in the Eurozone. If the economy of the Eurozone countries (a group of countries that use the euro) is growing, this can strengthen the euro, as investors and traders will be more interested in euro assets.

-

The unemployment rate in Europe. A low unemployment rate usually signals a strong economy and can support the euro exchange rate.

-

The interest rates of the European Central Bank (ECB). There is a European Central Bank, and the euro exchange rate "dances" around it. More precisely, when the ECB raises interest rates, it makes investments in euros more relevant. If the euro is relevant, it is bought more, and accordingly, the rate is higher.

-

Inflation. No classical currency can avoid inflation: both the dollar and the euro. High inflation in the Eurozone can reduce the purchasing power of the euro and weaken its rate. Low inflation helps maintain currency stability. Thus, inflation is a significant factor.

If the Eurozone exports more goods and services than it imports, this creates demand for euros and can strengthen its rate. A significant trade deficit can weaken the euro. This analogy works both with the USA and the dollar, as well as with the euro and the EU.

An important factor for the euro exchange rate is the investment environment. An influx of foreign investment into Eurozone countries can increase demand for euros, thus strengthening its rate.

Politics, Economy, and the World

Like any currency, the euro exchange rate is influenced by political and economic stability. This concerns not only Europe but the world in general. A stable political situation in the Eurozone countries supports confidence in the euro and can strengthen its rate. Political instability can weaken the euro. Thus, there is a direct connection.

Economic problems, such as financial crises or debts, can negatively affect the euro exchange rate. Again, it's about Europe or the world. Events in other countries and regions (for example, economic crises, trade wars) can influence the euro exchange rate. For example, instability in major economies can increase demand for the euro as a more stable currency.

Speculation and trading cannot be excluded. Currency traders and investors may buy or sell euros based on their expectations of the future rate. This affects the demand and supply of euros in the market.

Euro and Other Currencies

If the euro exchange rate is formed based on the interaction of economic indicators, monetary policy, political and economic stability, global events, and traders' actions, then the euro exchange rate influences other currencies.

Why does this happen:

-

The euro as a reserve currency. The euro is one of the main reserve currencies in the world, along with the US dollar. Central banks and investment funds hold euros in their reserves, and changes in the euro rate can affect the value of their reserves and investment strategies.

-

Many countries engage in significant trade with the Eurozone. Changes in the euro exchange rate can alter the value of goods and services that countries export or import. This can impact the economies of partner countries and their currencies.

-

Fluctuations in the euro exchange rate can change prices for goods and resources that countries buy from the Eurozone, which can affect their currency rates.

-

Changes in the euro exchange rate can affect the attractiveness of investment in the Eurozone. If the euro strengthens, foreign investors may be interested in investing in the Eurozone, influencing the currencies of their countries of origin.

-

Investments in euro-denominated assets may vary depending on the euro exchange rate, which in turn may affect demand for other currencies.

On currency markets, the euro is traded against other currencies, such as the US dollar and the British pound. Fluctuations in the euro exchange rate can influence the exchange rates of these currency pairs. This relationship can be used for investment purposes.

Read also

- What to see in Bukovel: winter, summer and autumn

- What to see in Iceland: in winter, in summer, on a tour

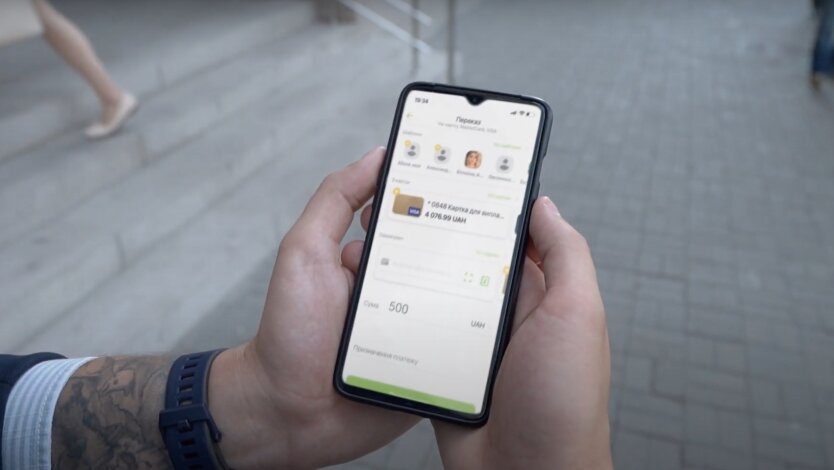

- What is p2p and pay2pay transfer

- Best Adult Films: TOP 5 Films