Tax Increase in Ukraine: Experts Described Possible Scenarios.

The Government of Ukraine has proposed changes to the tax system to support the defense budget amid a prolonged war. Current war expenses amount to 5.6 billion UAH daily.

The proposals to bill No. 11416 include increasing the military tax rates for individuals and legal entities. Additionally, there are planned additional levies on transactions with banking metals, sales of jewelry, new cars, and real estate sales by individuals.

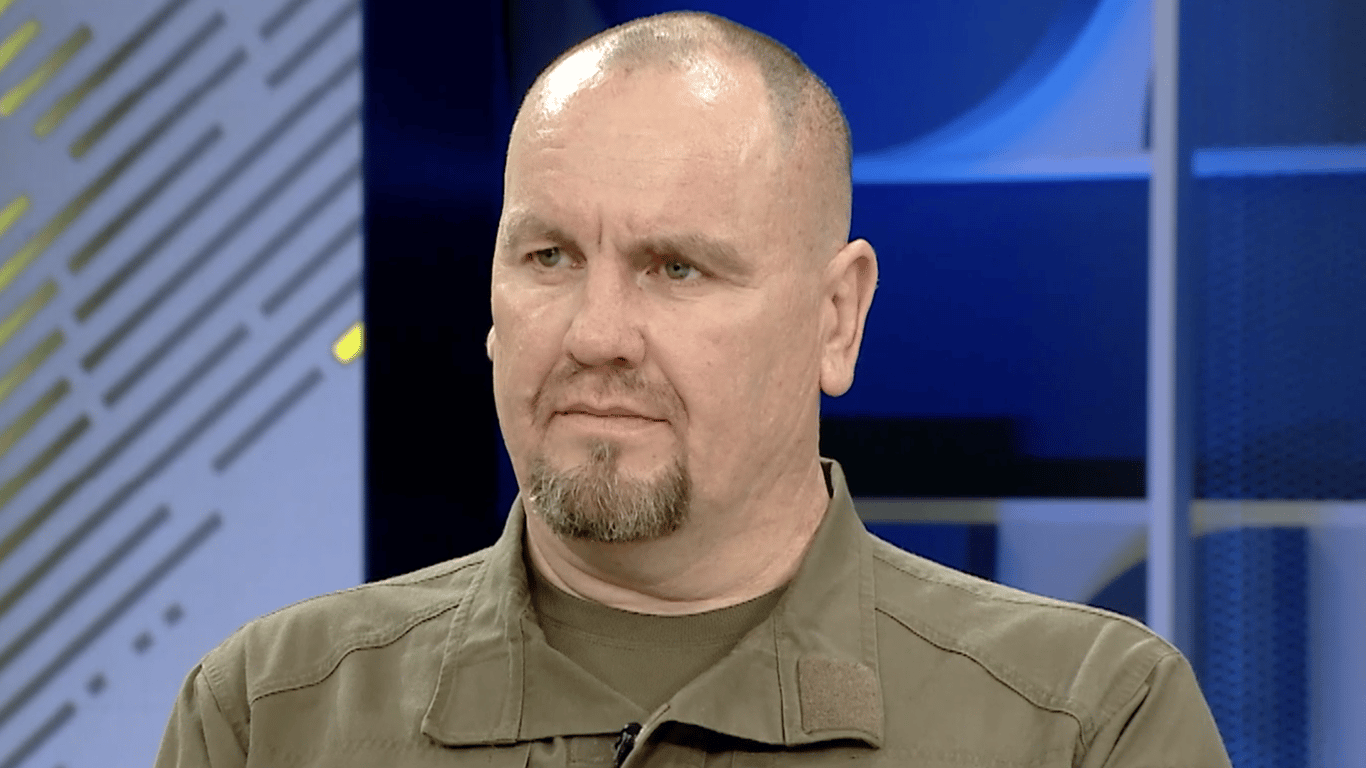

However, experts express their skepticism about these tax changes. They warn of the risk of a growing shadow economy and the negative impact on businesses and employees.

The decision on changes to the tax system needs to be made urgently, as it affects the financial stability of the country. However, it is important to find a balance to avoid overburdening the economy and increasing the risk of the shadow sector.

Read also

- Protecting Ukraine - a volunteer from Hungary died on the front line

- The Russian vessel detained in Odesa has had its arrest lifted - details

- How the Skynex system shoots down drones - The Air Force showed the video

- Not only disruption of mobilization — Tymochko named the reason for the attacks on TCK

- Attack by the Russian Federation on Chernivtsi — what is known about the victims

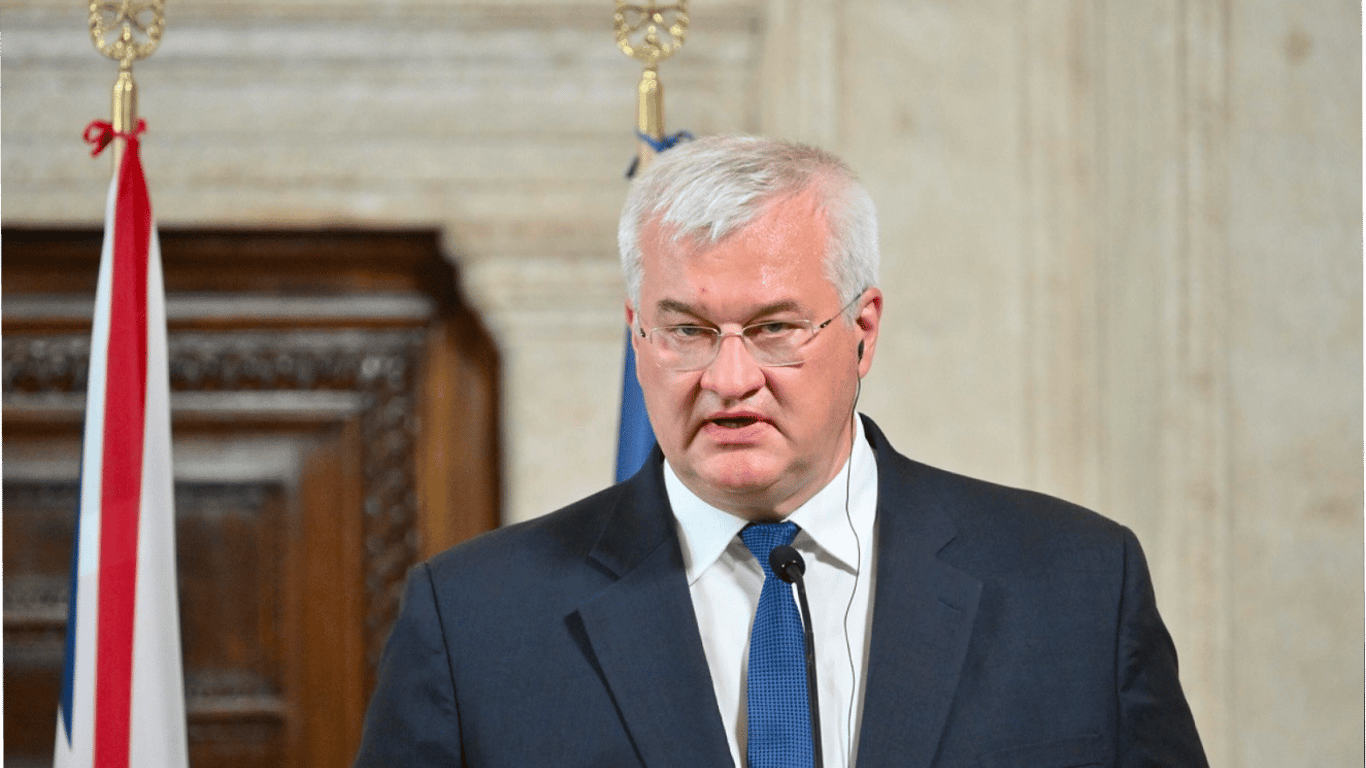

- What is needed to end the war — Sybiha responded