What Currencies Are Best to Store Money and Savings.

Currency savings can help earn money, but they are also quite risky. However, if there is still a desire to invest funds in foreign currency, it is worth considering which currency to hold money in.

When exploring the question of which currency is better to hold money in, it is important to understand the risks associated with such investments, especially now during a rather unstable Time. Today, any savings might lead to a switch in the field of activity. This fact also needs to be taken into account.

Which Currency is Best to Hold Money in?

In Ukraine, the choice of currencies for storing savings depends on several factors, including the economic situation, currency fluctuations, and personal preferences. Therefore, the question of which currency is best to hold money in today is quite complex. However, if considering the investment climate in Ukraine, it is not experiencing the best of times.

Which currency is better to hold money in right now:

-

Hryvnia (UAH). Advantages: storing funds in the national currency is convenient for everyday expenses, as there is no need to convert money. Also, higher interest rates on deposits are often offered in hryvnias. Risks: the hryvnia is susceptible to inflation and exchange rate fluctuations, especially during periods of economic instability. This may lead to a loss of purchasing power.

-

US Dollar (USD). Advantages: the dollar is considered one of the most stable currencies in the world. Holding savings in dollars can protect against inflation and devaluation of the hryvnia. Additionally, the dollar is widely used for international payments. Risks: during periods of hryvnia strengthening, there may be a loss when converting back to the national currency. Furthermore, interest rates on dollar deposits are usually lower than in hryvnias.

-

Euro (EUR). Advantages: the euro is also a stable currency and can be advantageous for those planning trips to Europe or making purchases in euros. The euro is often used as a reserve currency. Risks: fluctuations in the euro exchange rate may lead to losses when converting to hryvnia. Interest rates on euro deposits are also not high.

Gold often competes with currency investments. It is considered a "safe haven" during periods of economic instability. The price of gold typically rises during crises, which can help preserve or even increase savings. The risks of such deposits: the price of gold can be volatile, and losses can occur over short periods. Storing gold requires additional expenses for security.

Unreliable Currencies in Ukraine

There are also currencies in Ukraine that should definitely not be invested in. Due to the war in Ukraine, there is no point in investing savings in Russian rubles and Belarusian rubles. As for other currencies, it is certainly unwise to invest in the Turkish lira (TRY). The Turkish lira exhibits one of the highest degrees of volatility among world currencies. Economic instability and inflation make this currency risky for savings. Despite high inflation, interest rates on lira deposits may be insufficient to compensate for losses from inflation.

The Argentine peso (ARS) may rival the Turkish lira. Argentina has been struggling with hyperinflation for many years, making the Argentine peso extremely unreliable. Frequent government interventions and restrictions on currency exchange create additional risks for holding savings in this currency. It is also not advisable to invest funds in the Nigerian naira (NGN). Nigeria faces serious economic issues, including high inflation and budget deficits, making the naira unstable. Political instability in the country also plays a significant role in weakening the national currency.

These currencies are characterized by high risk and low stability, making them less suitable for long-term savings. Storing savings in such currencies may lead to significant financial losses, especially in times of economic crises and political instability.

How to Invest in Foreign Currency?

One of the best ways to protect savings is to diversify assets by distributing them among hryvnias, dollars, euros, and possibly gold. It is also better to monitor the economic situation closely. It's important to keep an eye on macroeconomic indicators such as inflation, the exchange rate of the national currency, and global trends to respond promptly to changes.

Regarding investment, it is advisable to consider both short-term and long-term goals. If the savings are intended for short-term expenses, it makes sense to hold them in hryvnias. For long-term savings, such as investments or large purchases, dollars, euros, or gold can be considered.

Thus, the best choice of currency for savings depends on your goals and risk tolerance.

Read also

- What to see in Bukovel: winter, summer and autumn

- What to see in Iceland: in winter, in summer, on a tour

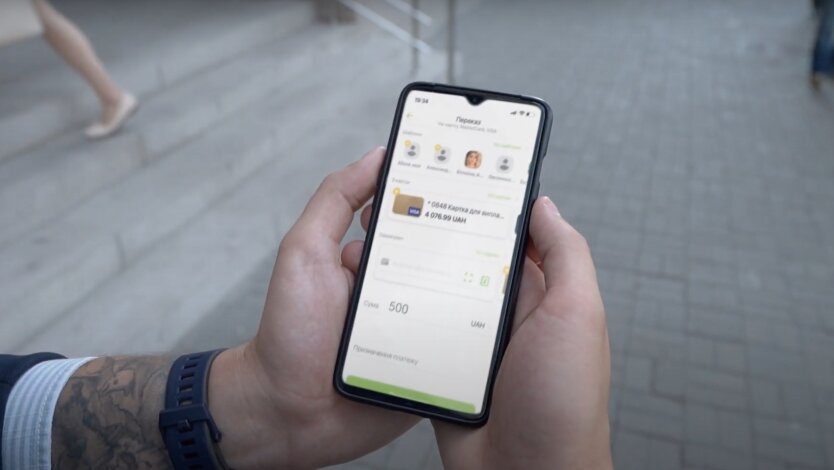

- What is p2p and pay2pay transfer

- Best Adult Films: TOP 5 Films