In Ukraine, the deadlines and form for submitting tax reports have changed.

The Ministry of Finance of Ukraine has made significant changes to the tax reporting system, which has caused a loud resonance among taxpayers. These changes concern both legal entities and individual entrepreneurs who pay funds to individuals. The main purpose of the innovations is to increase the effectiveness of control over budget revenues.

Changes in the Reporting Period

In autumn 2024, important changes were adopted to the Tax Code of Ukraine, which provide for the transition to monthly reporting instead of quarterly. Starting in 2025, taxpayers will be required to submit an updated report every month within 20 calendar days after the end of the reporting month. During the transitional period, by February 10, 2025, reports for the fourth quarter of 2024 will be submitted in the old form, and by February 20 - reports for January 2025 - in the new form.

Expanded Report Structure

One of the main differences of the new report form is its expanded structure, which now includes the main calculation and four appendices: information about the ЕСВ, income data, information about employment relations, and special experience. The introduction of combined reporting with monthly submission will simplify the reporting process for taxpayers and ensure more transparent control over budget revenues, experts note.

The changes were made based on two orders from the Ministry of Finance of Ukraine: No. 39 of January 24, 2025, and No. 53 of January 30, 2025, which were registered with the Ministry of Justice.

It is worth noting that the increase in taxes has led to a mass closure of entrepreneurs in Ukraine.

Read also

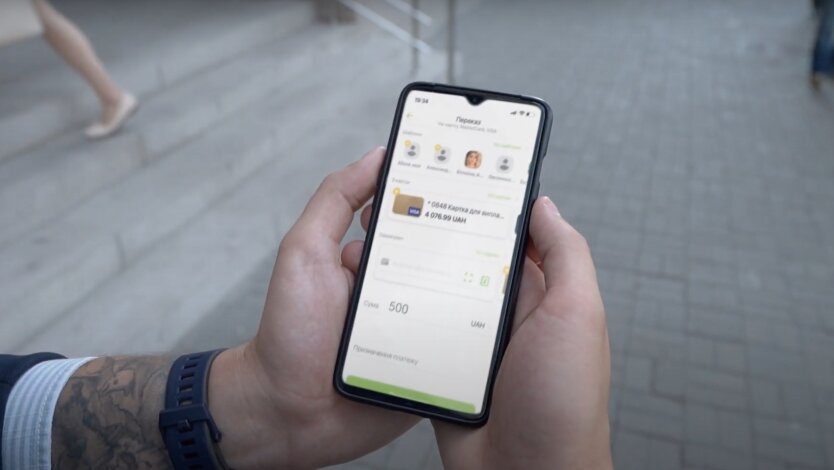

- New Opportunity for Entrepreneurs: PrivatBank Simplified Key Procedure

- Transition from dollar to euro: NBU names timelines, and IMF - conditions

- Not only tax: who else will gain access to the banking secrets of Ukrainians

- Blood group linked to early stroke risk: study results

- Zelensky confirmed the death of the commander of the 110th Mechanized Brigade, Zakharievich, as a result of a missile strike

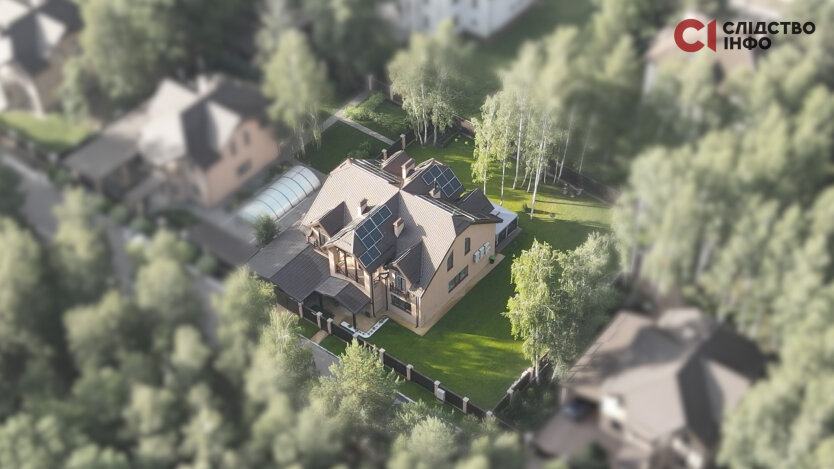

- The former head of the Brovary TCC was found to own elite real estate and a fleet of vehicles