What is the listing of cryptocurrencies and tokens.

Cryptocurrency is developing quite rapidly as a separate system. In this process, there are a large number of various operations. Therefore, everyone who wants to work and earn in crypto should think about what token listing means.

At first glance, the concept of what listing is in crypto seems straightforward. However, in reality, what listing means in cryptocurrency can be understood quite simply and quickly.

What is cryptocurrency listing?

So, what is cryptocurrency listing and how can a token help those who want to earn in crypto: listing of cryptocurrencies and tokens is the process of adding a digital asset to a cryptocurrency exchange or trading platform. In other words, what listing of a coin means in simple terms is the appearance of a new unit on the exchange. After all, crypto is not just the popular Bitcoin. It can happen that a new coin appears on the exchange.

It is important to understand not only what it is but also how it works. Listing allows users to buy, sell, and exchange cryptocurrencies on the exchange, increasing the liquidity of the asset, its recognizability, and, as a result, its market value. This always follows a simple scheme. A new coin appears on the market with its guarantee and so-called foundation. The more popular this coin is, the higher the importance of this crypto rises.

Listing of cryptocurrencies is a fairly simple procedure in which the exchange accepts a new digital asset and provides its users with an opportunity to conduct operations with it. Undoubtedly, exchanges do not accept every coin. After listing, the crypto can be bought or sold. This increases its demand and also boosts liquidity.

An important point is which exchanges and which assets are offered for sale. After all, exchanges establish which crypto to list. The listing procedure includes a series of checks to ensure that the asset meets the platform's requirements and does not violate laws. Therefore, for the average user, this process is simple, while in reality, it is quite a complex system.

What is the purpose of listing?

Listing is a very important process. It is also very significant for those companies that release crypto. It is advantageous for ordinary users, as they can earn quite quickly on a new asset.

In general, listing plays a key role in the cycle of any cryptocurrency project. It affects the following:

-

When an asset is listed on an exchange, it makes it available to a larger number of users. Essentially, the more people buy or sell crypto (the new asset), the greater the liquidity increase. This allows users to quickly buy or sell the asset without significant price changes.

-

Thanks to listing, assets become available for investors. The exchange acts as an intermediary between investors and the project. After that, the investor can sell the assets. For this, they use convenient tools.

-

Listing on a well-known exchange increases the cryptocurrency's recognition and confirms its reliability. The more platforms offer to trade the asset, the more attention the project attracts from investors.

-

Thanks to this process, the market value of the asset also increases. In most cases, after successful listing on a major exchange, the cryptocurrency's price rises due to increased demand and a broader range of buyers.

In general, listing is a very effective and beneficial process.

How does listing occur?

So, the process has its simple algorithm. It may slightly vary depending on the exchange. Nevertheless, there is still a general algorithm. What are the standard stages:

-

Verification. The exchange must check the project before making a decision on listing. Aspects such as the project team, technology, transparency, legality, and the financial condition of the company are analyzed.

-

Legal verification. The project must comply with the legislation of the country where the exchange is registered. This is important to avoid claims from regulators and to protect both the project itself and its users.

-

Verification of technical architecture. Exchanges analyze the blockchain technology on which the token is based, checking security, scalability, and the possibility of integration with the platform.

There are exchanges that request payment for listing. This amount can also vary (it all depends on the exchange). The complexity of verification also influences the cost of listing.

Next, an audit must be conducted. Exchanges are interested in ensuring that the assets traded on their platform are protected from hacks and attacks. This may include an independent security audit of smart contracts.

After the asset is placed, it needs to be promoted. Marketing support is used for this purpose. Exchanges may offer additional promotion services for the new asset, including mailings, press releases, and participation in trading competitions. Many tools are used for this.

Read also

- New Opportunity for Entrepreneurs: PrivatBank Simplified Key Procedure

- Transition from dollar to euro: NBU names timelines, and IMF - conditions

- Not only tax: who else will gain access to the banking secrets of Ukrainians

- Blood group linked to early stroke risk: study results

- Zelensky confirmed the death of the commander of the 110th Mechanized Brigade, Zakharievich, as a result of a missile strike

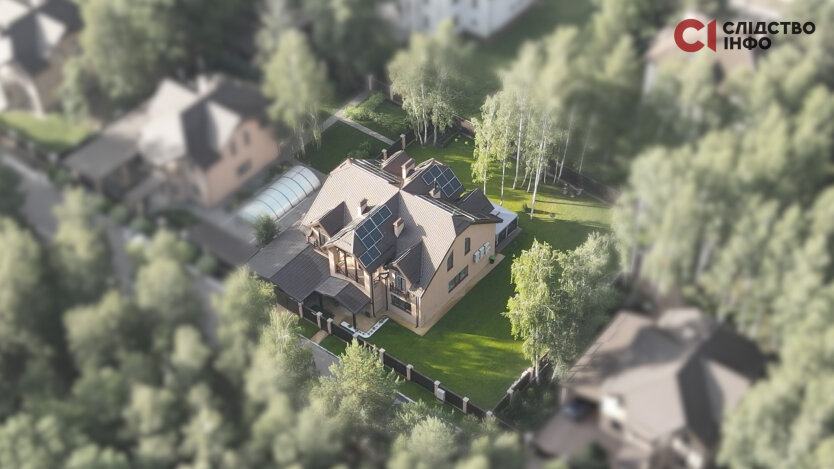

- The former head of the Brovary TCC was found to own elite real estate and a fleet of vehicles