They will have access to all accounts: the tax authorities will be able to 'see' the money of Ukrainians abroad.

From September 30, 2024, the State Tax Service of Ukraine will gain access to information on foreign bank accounts of Ukrainian residents. This will become possible due to Ukraine's joining the international system of automatic exchange of financial information in accordance with the Common Reporting Standard (CRS).

This is reported by the «Judicial and Legal Newspaper».

The CRS system, which unites 115 countries, including all EU member states, will allow Ukrainian tax authorities to receive data on citizens' financial accounts without separate requests and notifications to account owners. The information will be automatically received from the tax authorities of other countries participating in the system.

Danilo Hetmantsev, head of the Verkhovna Rada Committee on Tax Policy, noted that the Tax Department will gain access to a wide range of financial information. This will include data on the status of bank accounts, information on participants in international corporate groups, information on tax payments, income volumes, types of activities, and the number of employees in different jurisdictions.

The first data exchange will cover the period from July 1 to December 31, 2023. Further exchanges will occur annually, based on information for the full calendar year preceding the exchange year.

Importantly, on June 26, 2024, the State Tax Service received an approved report from the OECD global forum on Ukraine's readiness for information exchange for tax purposes. This confirms that Ukraine is technically and legislatively ready to connect to the CRS/CbC systems.

Previously, a lawyer explained how these changes will affect refugees from Ukraine to the EU.

Read also

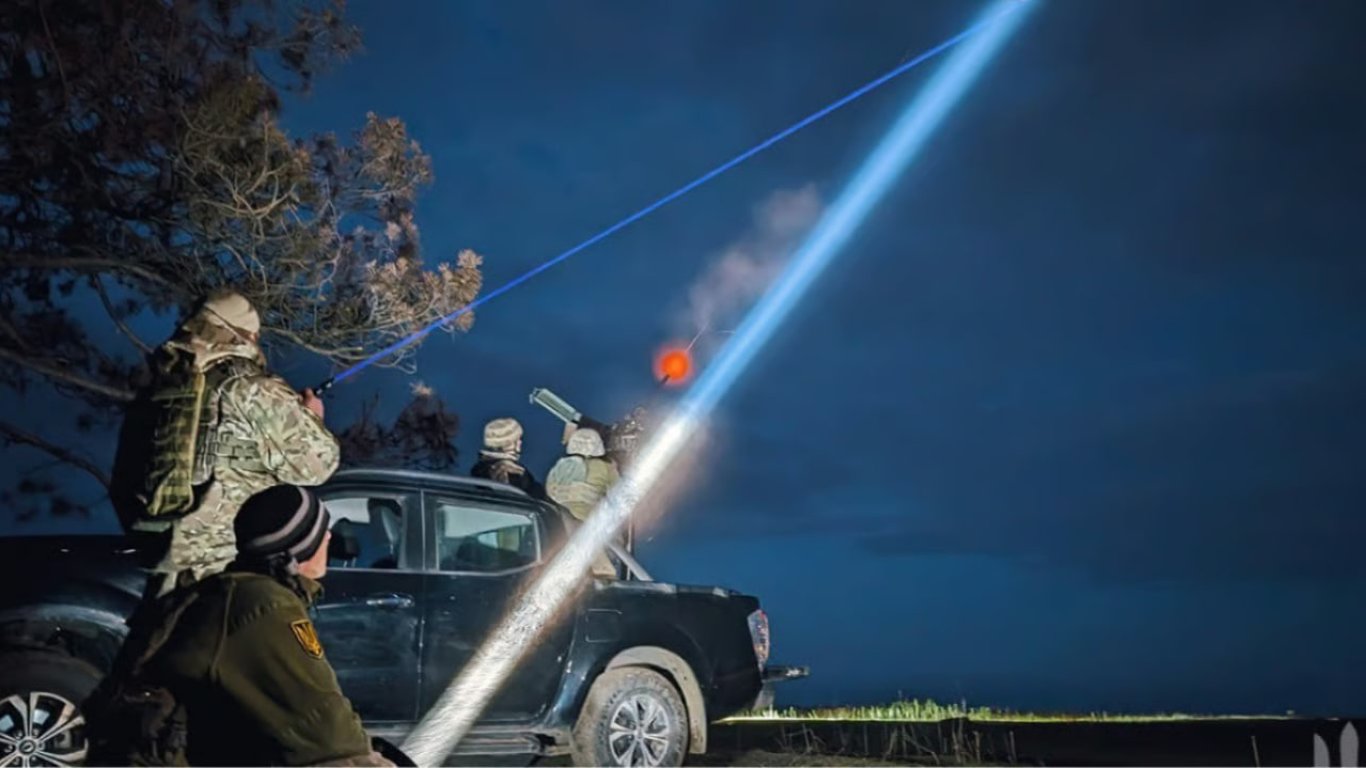

- Russia is attempting to land troops in southern Ukraine - details

- Russia expands propaganda presence in Africa - GUR

- The assassination of Colonel Voronych in Kyiv - the SBU eliminated the assassins

- Kalibrs at Sea - Military Report on the Deployment of Russian Ships

- Payments to the Armed Forces of Ukraine - who can receive financial assistance in July

- Russia attacked Ukraine with drones - how many were shot down by air defense forces