The Tax Service Massively Checks Online Business: What Entrepreneurs Can Be Fined For.

The Tax Service Checks Online Business

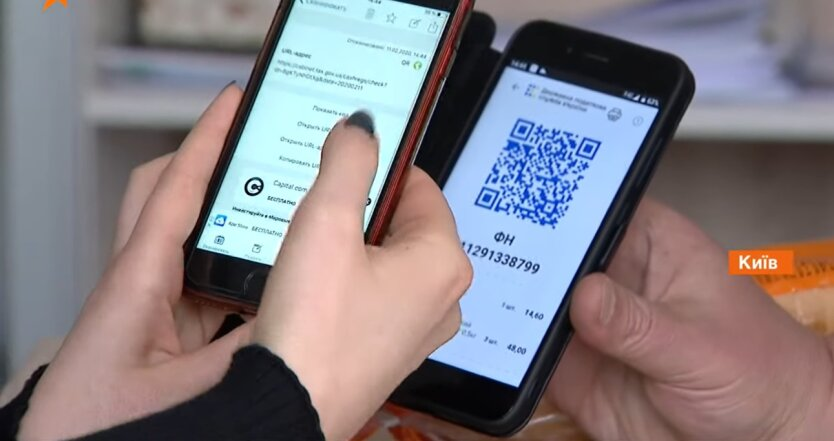

Since the beginning of November 2024, the Tax Service has conducted about 50 audit inspections and discovered numerous violations in the use of cash register systems (CRS). Special attention is paid to monitoring internet platforms and sites where goods are sold. During the inspections, facts were established regarding the sale of expensive equipment and electronics without the use of CRS and without accounting for inventory.

Since the beginning of November 2024, the Tax Service has conducted about 50 audit inspections that revealed numerous violations in the use of CRS. During the inspections, facts were established concerning the sale of expensive equipment and electronics without the proper use of CRS and accounting for inventory.

Penalty Sanctions for Violating Cash Discipline

As of October 1, 2023, penalty sanctions for violating cash discipline have been reinstated. For the first violation, a fine of 100% of the value of sold goods or services is provided, for a repeat violation - 150%. For single taxpayer entrepreneurs who are not VAT payers, preferential conditions apply until July 31, 2025. Their fines are 25% of the value of goods for the first violation and 50% for the repeat violation. The sale of excise goods, technically complex household goods, medical products, and jewelry does not fall under these privileges.

As of October 1, 2023, penalty sanctions for violating cash discipline have been reinstated. For the first violation, a fine of 100% of the value of sold goods or services is provided, for a repeat violation - 150%. For single taxpayer entrepreneurs who are not VAT payers, preferential conditions apply until July 31, 2025.

Results of Inspections

Penalties totaling 1.4 million hryvnias have already been imposed.

Read also

- eOselya — who cannot qualify for affordable lending

- Koreans will build a waste incineration plant in Odesa - what are the timelines

- Problematic dollars — which banknotes cannot be exchanged

- Discounts on products up to 55% — what is offered at Silpo significantly cheaper

- Impressive in price and high demand — which silver grade is the most expensive

- Housing in the largest district of Kyiv — where to buy a one-bedroom apartment at a good price