What is Market and Stock Volatility.

The stock market allows for good earnings. However, to earn, one needs to learn certain terminology. For example, what is stock volatility.

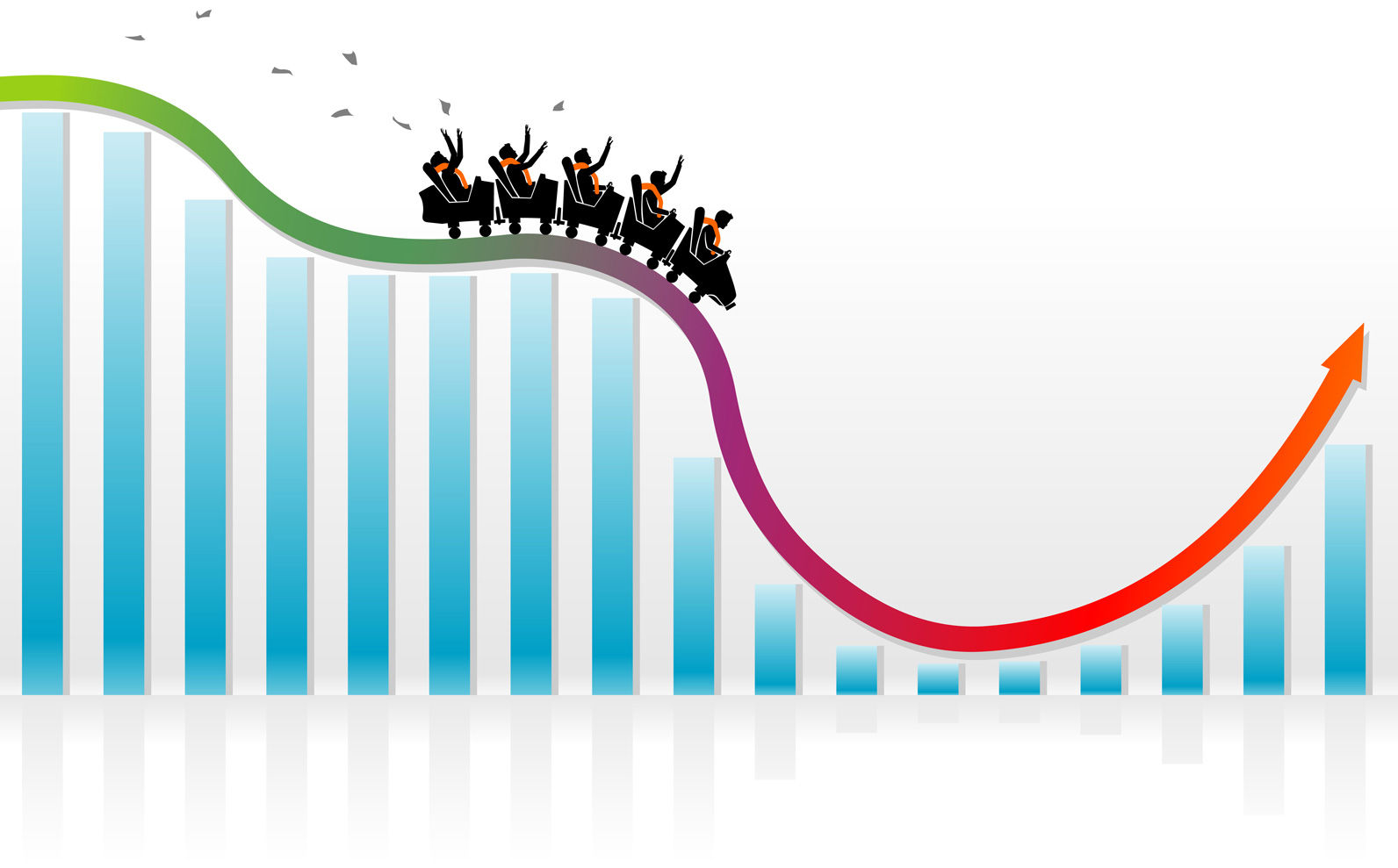

When understanding what market volatility is, it is essential to recognize that this is a key term for investing in the stock market. In other words, all investors will have to understand what market volatility means. In simple terms, it is a measure of how much an asset's price can change. This occurs within clearly defined Time frames.

What is Market Volatility?

So, what is it: a measure of how much the price of stocks or currencies fluctuates. We need to understand what volatility is immediately. It pertains not only to assets but also to commodities or even indices. In simple words, volatility is the level of risk associated with changes in the value of an asset. That is, if the price of an asset frequently and sharply changes, it is considered highly volatile. Moreover, if the price changes gradually and without significant jumps, the volatility is low.

Volatility is an important and quite accessible tool. For investors and traders, volatility is crucial:

- For traders, high volatility is an opportunity to profit from quick price changes.

- For investors, low volatility indicates asset stability and lower risk.

Therefore, such a concept is understandable and straightforward. This tool also has its types. What are they:

- Historical type. This shows how the price of an asset has changed in the past. It uses data from a specific period for its calculation.

- Expected type. This is a forecast of future price fluctuations. It is often used to estimate the value of options and other derivative instruments.

Each of these types has its own characteristics.

How is this concept measured?

Volatility is calculated using mathematical methods. The primary indicator is standard deviation. The higher the standard deviation, the greater the volatility.

To understand how this works, an example is necessary. If a stock's price fluctuated between 100 and 110 hryvnias over a week, the volatility would be low. If, in the same week, the price changed from 100 to 150 hryvnias, volatility would be significantly higher.

We should also mention the factors that influence volatility. What are they:

- Global economic news. This relates to inflation, changes in interest rates, GDP.

- Political instability. Includes elections, legal changes.

- Global events. Includes wars, pandemics, natural disasters.

- Company performance. Relates to the publication of reports, changes in management.

- Investment news. Relates to mass buying or selling of assets.

All these factors influence volatility in one way or another.

How does this indicator work in Ukraine?

In 2024, the Ukrainian economy faces several issues affecting the volatility of the stock and currency markets:

- First, we need to consider the stock markets. Shares of Ukrainian companies exhibit high volatility due to fluctuations in the economy and changing investment sentiments.

- Currency market. The exchange rate of the hryvnia depends on the external economic situation, inflation, and the policies of the National Bank of Ukraine.

It is worth mentioning volatility and how it can be used strategically:

- For traders. Choose assets with high volatility for short-term deals. Use technical analysis to predict prices. Set stop-loss orders to minimize losses.

- For investors. Invest in assets with low volatility to reduce risk. Diversify the portfolio to lessen the impact of price fluctuations. Study the fundamental indicators of companies.

This is sufficient to earn money in Ukraine even during war times.

Pros and Cons of Volatility

This tool has its pros and certain cons. They should definitely be weighed before making any decisions. First, let's recall the advantages of this process:

- First, it is an opportunity to profit from short-term price fluctuations.

- It can also serve as an indicator of market sentiment.

As for risks, we talk about:

- The fact that high volatility increases the likelihood of losses.

- Uncertainty also complicates forecasting.

In general, this tool can be used, but it's essential to consider both its advantages and disadvantages beforehand.

In 2024, investors in Ukraine face high volatility amid global and internal challenges. This presents opportunities for profit but also necessitates careful risk assessment. Overall, both traders and investors will benefit from monitoring news in politics and economics. This will help track all significant events in any markets where profit is possible. Meanwhile, market and stock volatility remains an essential indicator that helps understand risk levels and profit opportunities.

Read also

- What is MoneyGram in simple words

- What is needed for transferring and receiving money via Western Union

- What is Western Union in simple words

- Who is an acquirer in simple terms

- Who is an issuer in simple terms

- Is it possible to send money by mail abroad