Dollar at 45 hryvnias in the budget: expert revealed whether to prepare for devaluation.

The National Bank of Ukraine has changed the exchange rate of the hryvnia against the dollar and the euro. Experts confirm that the situation is under control.

Member of the National Bank of Ukraine Council Vasyl Furman explained that the hryvnia exchange rate in the currency market is stable and under the control of the NBU. The gold and foreign exchange reserves are sufficient to balance the market.

'The National Bank conducts a policy of flexible exchange rate formation in the currency market, and the hryvnia can fluctuate. The situation in the market is stable and under the control of the NBU,' Furman said.

Due to the war, the currency market of Ukraine is unbalanced due to the excess of imports over exports. However, thanks to international financial aid, a significant amount of foreign currency is being acquired.

According to NBU forecasts, the gold and foreign exchange reserves will grow to over 40 billion dollars by the end of the year.

Impact of the exchange rate on prices

Furman believes that minor changes in the hryvnia exchange rate are not a determining factor in price growth. However, it is necessary to avoid significant devaluation of the hryvnia, as many goods on the market have an import component.

Currently, in exchange offices, the dollar can be bought for 42 UAH and sold for 41.40 UAH. The exchange rate for the euro is 44 UAH for purchase and 43.30 UAH for sale. However, the exchange rate indicators in the budget for the current year amount to 45 UAH per dollar.

State support programs

Furman also assessed the effectiveness of state support programs. For example, the 'Winter Support' program is very popular among the population - 12 million Ukrainians have used it.

The expert emphasized the importance of the '5-7-9%' program for small and medium-sized businesses, as well as the preferential mortgage at 3-7% per annum in hryvnia.

Interest rates on loans in hryvnia have returned to pre-crisis levels - 12-14% per annum. The banking system remains profitable, earning over 100 billion UAH.

Furman noted that today it is advantageous to invest in hryvnia assets, as their yield is higher than inflation. Deposits in hryvnia yield 14-16%, while deposits in dollars yield from 0.5% to 3%.

Read also

- How to pay less for electricity in summer — DTEK named an important nuance

- The firewood season has begun - where to buy and how much does it cost

- Ukrainians will receive assistance of 100 thousand UAH - program conditions

- Gifting an apartment - how much tax will the deal 'eat up' in 2025

- The Minimum Subsistence Level and Pensions - What Will Happen to the Amounts in August

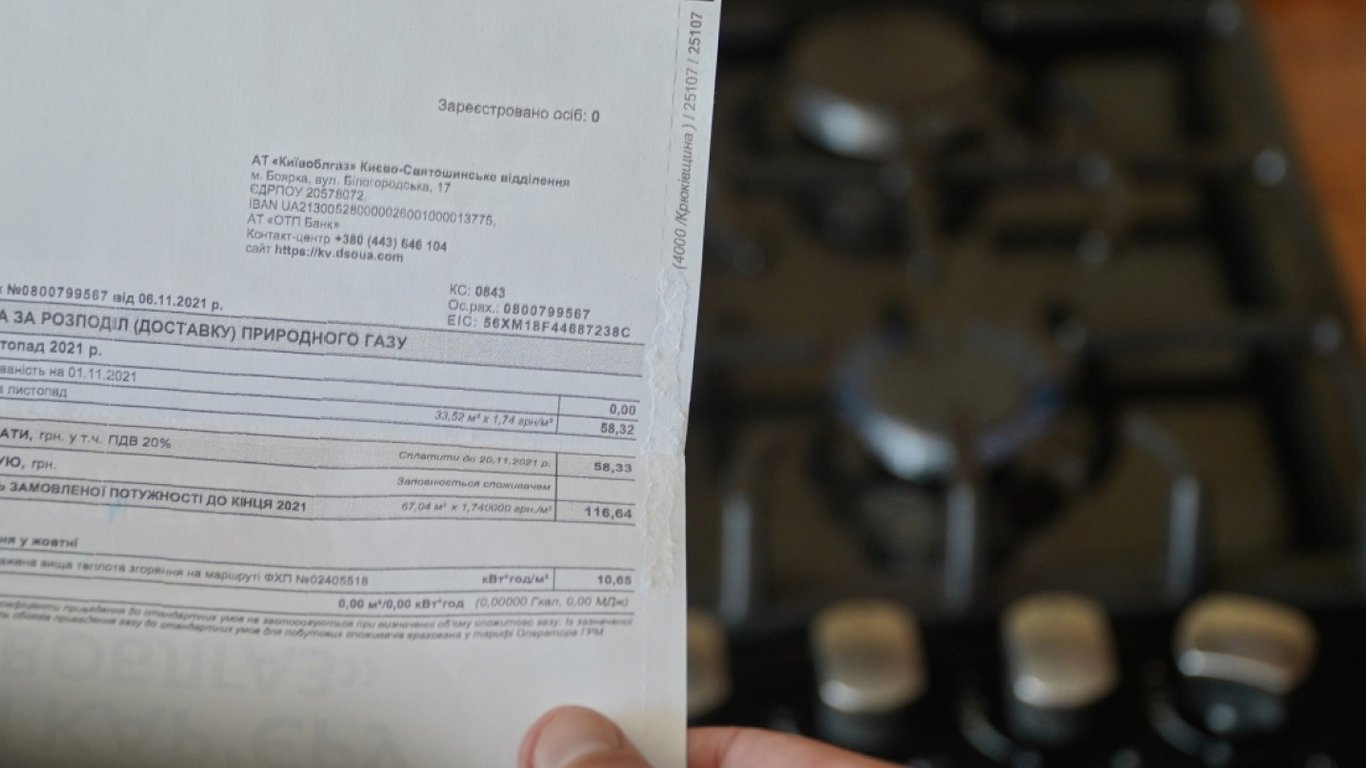

- Naftogaz Clients Are Charged Excess Gas Volumes - Details