Housing prices in Britain have reached nearly record levels.

Housing prices in Great Britain reached nearly record-high levels at the end of 2024, averaging £269,426. Compared to the previous month, prices increased by 0.7%. However, this figure is slightly lower than the record set in the summer of 2022, which was £273,751. For the fourth consecutive month, an increase in housing prices has been observed, related to demand from buyers, particularly with an increase in the number of approved mortgages, which reached the highest level in the last two years.

In northern England, housing prices are rising faster than in the south. In London, prices remained virtually unchanged during the second and fourth quarters of the year, averaging just over £525,000. Overall, throughout the year, housing prices in Britain increased by 4.7% compared to December 2023.

The housing market is supported by rising real incomes and the alleviation of uncertainty related to the Labour budget, which was announced last year. The Treasury has reduced tax burdens for consumers by £40 billion.

«Activity in the mortgage market and housing prices in 2024 proved to be exceptionally resilient, despite ongoing affordability issues faced by potential buyers», noted Nationwide Chief Economist Robert Gardner.

It is expected that housing affordability issues will continue into 2025, but the Bank of England will provide limited assistance to potential buyers. According to Bloomberg Economics forecasts, housing prices will rise by 4% in 2025, but housing affordability will increase more slowly.

According to the UK Central Statistical Bureau, to purchase an apartment at an average price of £298,000, one needs to have free capital investments of £69,677 (£3.71 million UAH). This is only affordable for 10% of the wealthiest households in the country. Even affluent individuals cannot afford to buy property in London.

Read also

- Vladimir Day 2025 - History of the Holiday and Congratulations on the Name Day

- Kyiv in danger — developer 'Avtostrada' destroys the city's water bodies

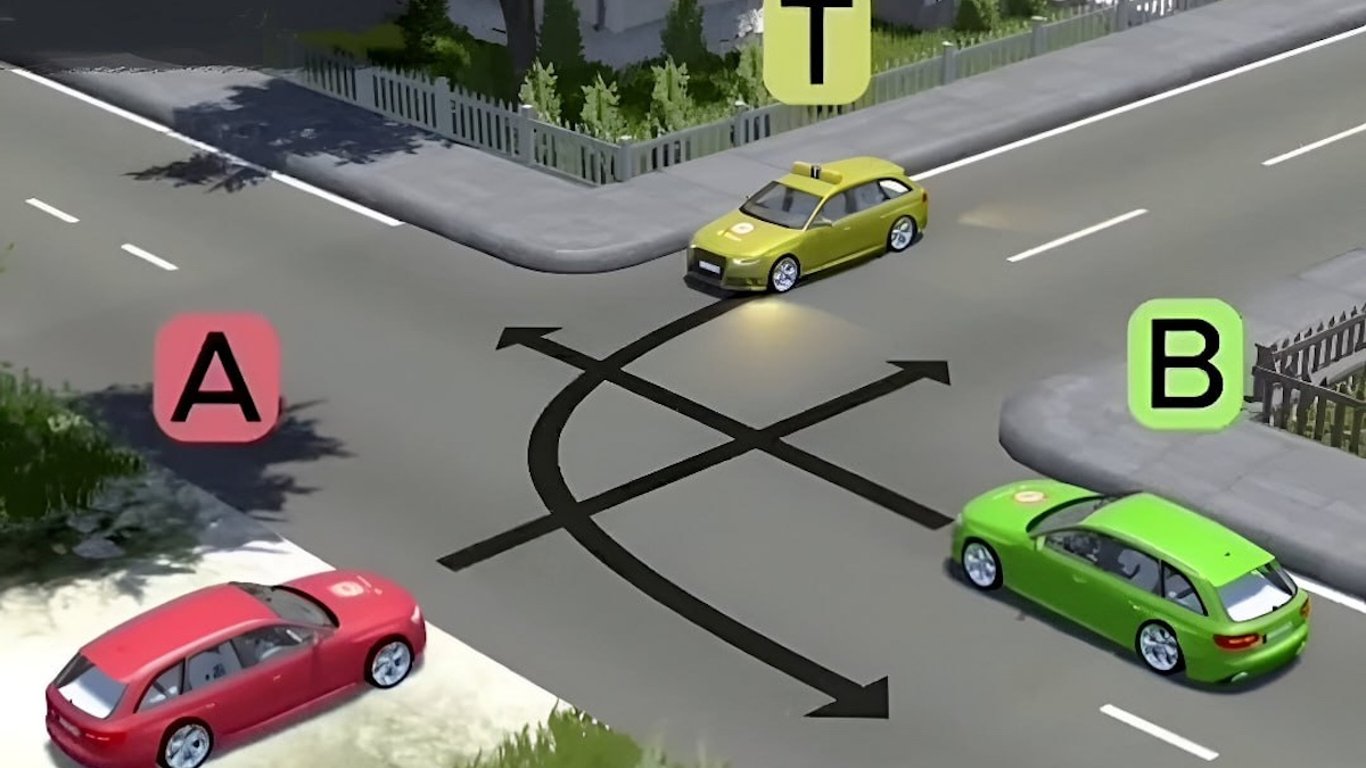

- Test of Traffic Rules for the Attentive - Who Passes the Intersection First

- In Odesa, a man stole icons from a church - what he faces

- What Latin letters mean on Ukrainian car number plates

- Alimony for parents - when children should provide financial support