Global Demand for Gold Sets New Record.

World gold demand increased by 5% in the third quarter of 2024, reaching a record of over $100 billion. These data are provided by the World Gold Council (WGC). The increase in gold demand to 1,313 tons has become possible due to the growing interest in gold in the West, particularly among wealthy individuals. This offset the reduced interest in gold in Asia.

The price of gold continued to rise for many months this year, except for a slight decline in January and June. Currently, the price per ounce of gold is about $2,790, which is a record high.

For the entire year, the price of gold increased by a third. The growth was facilitated by active purchases by central banks and increased interest from wealthy investors. The central banks of Poland, Hungary, and India purchased the most gold. Additionally, the reduction in the interest rates of the US Federal Reserve System supported the value of gold.

According to the chief market strategist of the WGC, purchases on the opaque over-the-counter market became an important factor affecting prices.

Read also

- Military Man Sentenced by Odesa Court for Desertion

- Woman praised the Russian army on social media - what the court decided

- The resident of Kharkiv turned out to be a saboteur - how the court punished her

- A Russian killed a girl for drugs - why he was pardoned

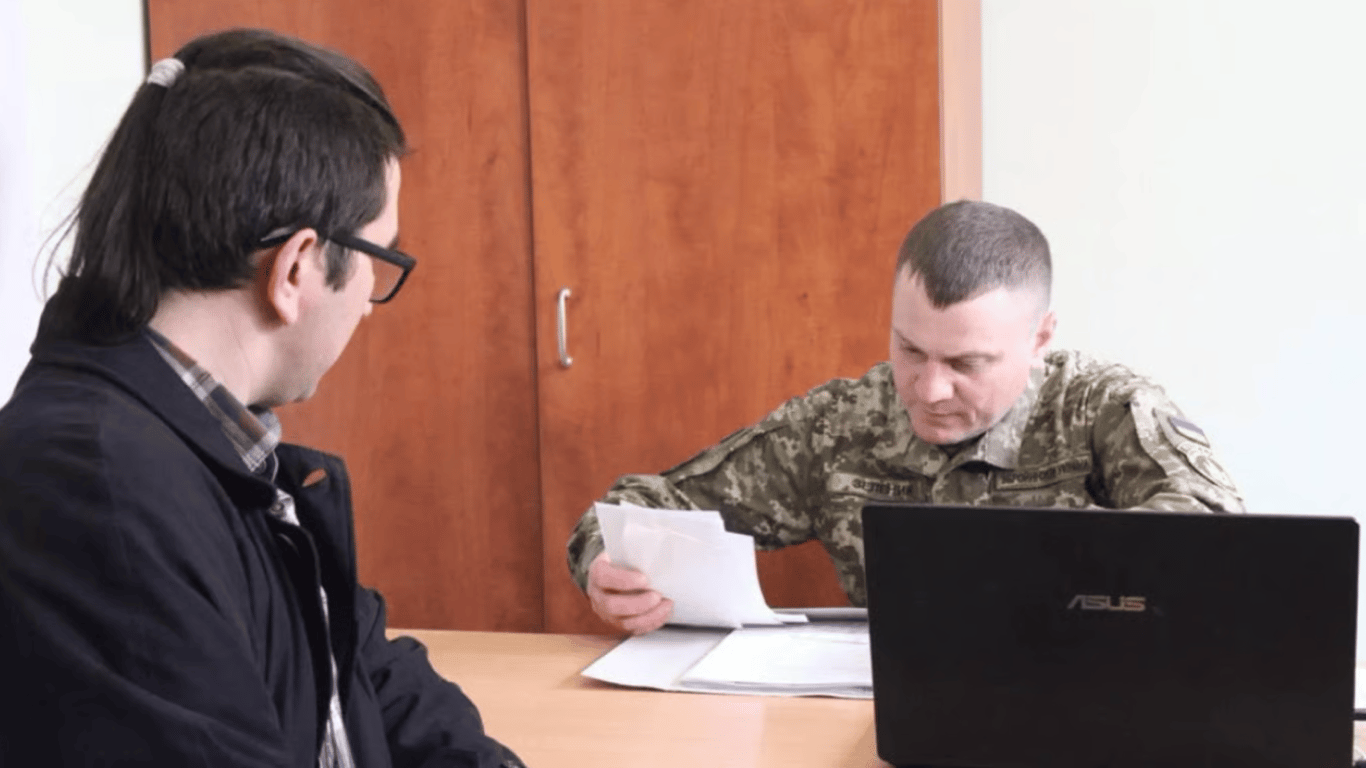

- Deferral for Caring for Grandmother - Necessary Conditions from TCC

- It became known how much allies will spend on weapons for the Armed Forces of Ukraine