NBU explained how long the regime of managed flexibility of the exchange rate will last in Ukraine.

NBU does not set exact Time frames for the managed flexibility regime of the exchange rate

At the beginning of the full-scale invasion, the NBU introduced a managed flexibility regime for the exchange rate in Ukraine. However, the regulator does not set exact time frames for the duration of this regime.

Deputy Governor of the NBU Yuriy Heletiy noted that there is currently no precision regarding the duration of the market's stay in the managed flexibility regime of the exchange rate.

According to him, the NBU has sufficient international reserves and instruments to maintain the current regime until conditions are created for further steps towards currency liberalization.

We are not tied to any time frames either in terms of calibrating the exchange rate regime or in the speed of progress along the currency liberalization roadmap. We focus exclusively on the conditions that need to be formed for the next steps, so they do not generate threats to the stability of the foreign exchange market, exchange rate, and inflation expectations - said Heletiy.

According to the Deputy Governor of the NBU, what matters is not the time, but the conditions that will ensure economic stability and not create threats to the stability of the foreign exchange market and inflation expectations.

The managed flexibility regime may seem similar to a floating exchange rate, especially to those who do not delve into the details of economic processes, notes Yuriy Heletiy.

However, these regimes have differences that affect ordinary citizens.

After the NBU adjusted this possibility, it disappeared, as did the meaning of this practice.

If we compare the current regime with the floating exchange rate regime that was in place before the full-scale war, then perhaps the changes for the cash rate are not significant. If we exclude the structural currency deficit on the interbank market, which the NBU covers and which does not exist in the cash market, the perception of the regimes is indeed similar - explained the banker.

As a result, the connection between official and cash rates has strengthened, and there are fewer reasons for people to worry about exchange rate spikes. This has also reduced the incentive to accumulate currency in conditions of economic instability.

Read also

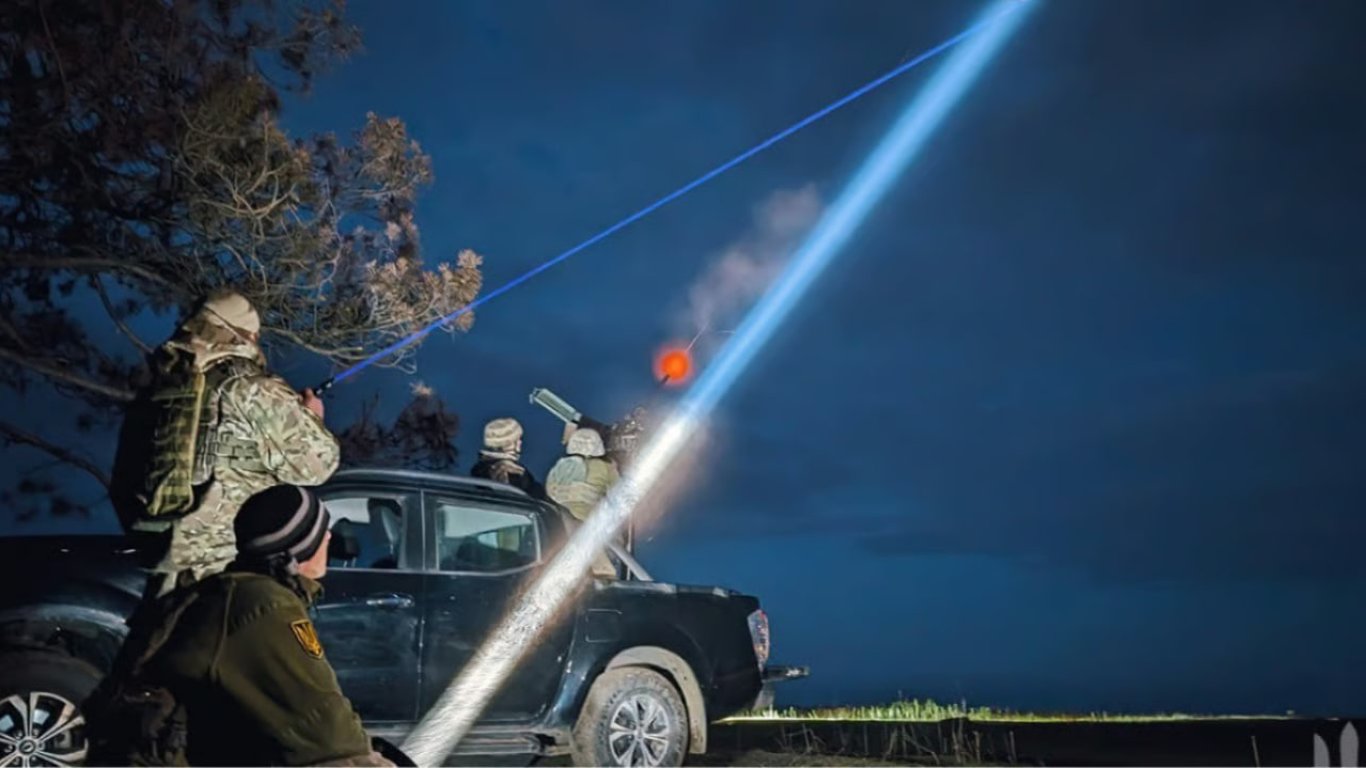

- Russia is attempting to land troops in southern Ukraine - details

- Russia expands propaganda presence in Africa - GUR

- The assassination of Colonel Voronych in Kyiv - the SBU eliminated the assassins

- Kalibrs at Sea - Military Report on the Deployment of Russian Ships

- Payments to the Armed Forces of Ukraine - who can receive financial assistance in July

- Russia attacked Ukraine with drones - how many were shot down by air defense forces