Land Tax: Who in Ukraine Can Avoid Paying for the Plot.

Owners of land plots and land shares, as well as land users, are taxpayers of the land tax. Land plots and land shares, which are owned or used, are objects of taxation by the land tax.

Local self-government bodies independently establish rates for land and land tax.

Individuals who are land tax payers have certain benefits. These benefits are established in accordance with the Tax Code of Ukraine.

persons with disabilities of the first and second groups; individuals raising three or more children under 18 years old; pensioners (by age); war veterans and persons to whom Law No. 3551-XII 'On the Status of War Veterans, Guarantees for Their Social Protection' applies; individuals recognized as a result of the Chernobyl disaster.

Exemption from land tax applies to land plots depending on their type of use with established maximum norms.

According to the norms of the single tax of the fourth group, owners of land plots and land shares who rent them out are exempt from tax payment.

Benefits for land tax are provided taking into account the data from the State Land Cadastre. The calculation of land tax is carried out separately for each individual by tax authorities.

Read also

- The educational ombudsman explained how to bring Ukrainian youth back from abroad

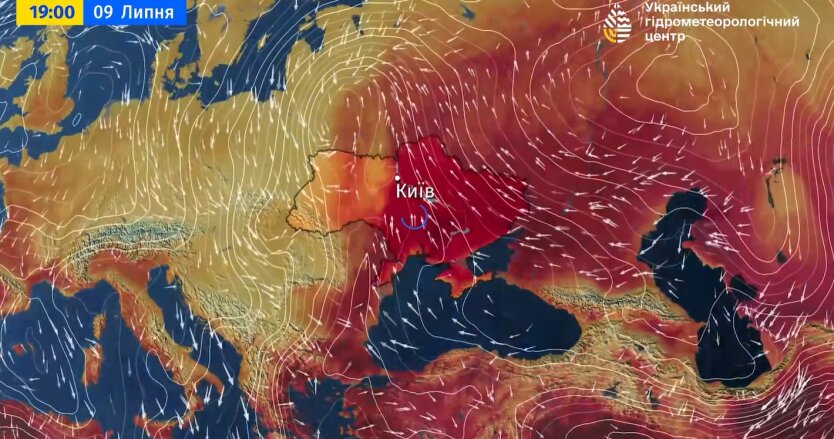

- From abnormal heat to stormy rains: forecaster Didenko warns of sharp weather changes

- New reports in Army+: Umierov explained how military personnel can arrange for dismissal after captivity and more

- Frontline Situation as of July 7. General Staff Summary

- Ukrainian artist Volodymyr Naumets has passed away

- Heatwave to hit Ukraine with temperatures up to +34: Meteorologists name the regions that will be affected by bad weather