Slovak Government to Raise Tax on Books.

The Government of Slovakia Considers Raising Tax on Books

This week, the government of Slovak Prime Minister Robert Fico is considering the possibility of reviewing the decision to raise the value-added tax rate on books from 10% to 23%. This step, which is part of a package of 17 measures to reduce the budget deficit, has sparked sharp criticism from publishers, political opposition, and students. This was reported by Politico.

«According to our analysis, books are mostly purchased by wealthy segments of the population, so they will be taxed at the highest VAT rate», – said Slovak Finance Minister Ladislav Kamenicky.

Finance Minister Ladislav Kamenicky stated that the VAT increase would primarily affect wealthy buyers, who, according to him, are the main consumers of books. However, this statement caused significant outrage, as, according to the Slovak Association of Publishers and Booksellers, most books are purchased by middle-class consumers, pensioners, and people with lower incomes.

«At the same Time, surprisingly many buyers are even among pensioners and people with lower incomes. Every obstacle that the state places in the way of publishing and selling books results in fewer books being published, bought, and thus read», – they stated.

The association warned that any additional obstacles in the field of publishing and selling books would lead to a decrease in the number of published and read books, which could negatively affect the level of education in the country.

After a wave of criticism, Kamenicky clarified his words, stating that his comments were misunderstood, and emphasized the importance of education for Slovak society. He also proposed lowering the VAT on school textbooks from 10% to 5%.

Interior Minister Matus Sutaj Estok noted that the government would review the decision to raise VAT on books, taking into account public outrage.

Read also

- Thunderstorms and downpours are coming to Ukraine - where to expect precipitation tomorrow

- What is the fine for listening to music in a car

- Deferral for Study - Two Types of Required Documents

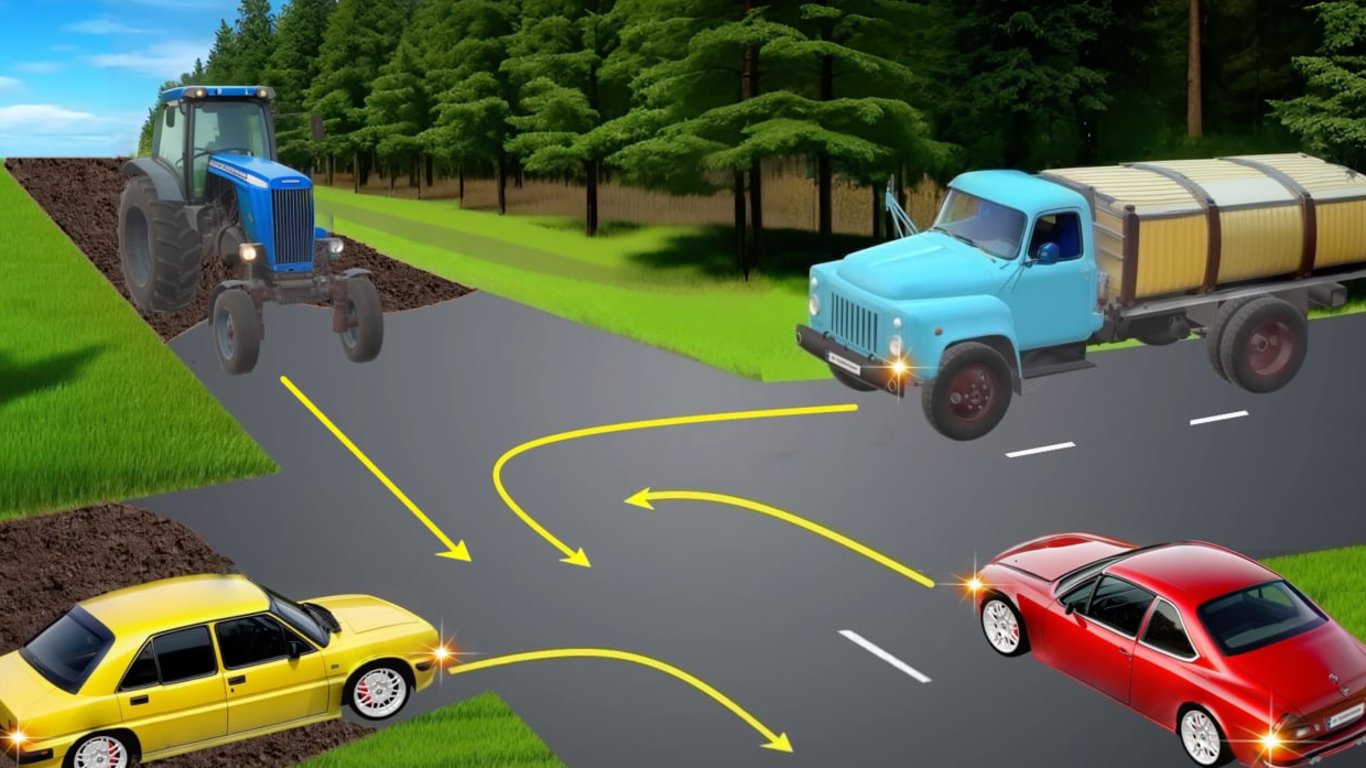

- Test of Traffic Rules — Who Will Pass the Intersection First and Last

- Transportation Benefits — Who Will Travel for Free Starting September 1

- Fishing Restrictions — Who Can Be Fined Even at Home